With Wall Street’s unpredictable nature on full display this week, savvy investors should take a step back and analyze the factors at play. The recent fluctuations in stock values are not just the typical ebb and flow; they are emblematic of a broader tension influenced by geopolitical, economic, and corporate earnings dynamics. The volatility we see is more than just statistical noise; it is a clarion call for investors to reassess their tactics and beliefs about market psychology and its implications for our financial futures.

The Turbulent Investments Landscape

On Friday, the atmosphere on Wall Street reflected a blend of anxiety and tentative hope, largely shaped by the U.S.-China trade relations. The White House expressed optimism about a potential deal, while Beijing retaliated with significant tariff hikes—a classic tug-of-war that reflects deeper economic discontent and uncertainty. This isn’t just about one country versus another; it impacts global supply chains, consumer prices, and ultimately, stock performance.

Anxiety trailed in the wake of President Trump’s aggressive tariff announcements, leading many investors into a frenzy of buying and selling that the S&P 500 hasn’t witnessed since World War II. The dynamic showcased how fear can cause knee-jerk reactions, leading to sought-after bargains one day and frenzied sell-offs the next. This is further complicated by the fact that certain sectors, particularly tech and manufacturing, find themselves disproportionately impacted. So, as we navigate this treacherous investment landscape, it’s paramount to dissect our own biases about risk and potential gain.

The Reality of Earnings Reports

The emotional rollercoaster was not limited to external factors like trade wars; corporate earnings reports played their significant role too. Major players like Wells Fargo and BlackRock saw their stocks swing dramatically in response to quarterly revenue announcements. While Wells Fargo struggled with lower-than-expected performance, BlackRock’s strong results significantly boosted investor confidence.

This scenario is crucial for investors to digest—earnings reports should never be dismissed as mere statistical data. Instead, they offer vital insights into a company’s operational health, consumer sentiment, and future projections. The stock market is not just numbers on a screen; it represents real people’s lives, dreams, and financial stability. Understanding this can reshape your investment philosophy into a more responsible, future-oriented endeavor.

Chipmakers Leading the Charge

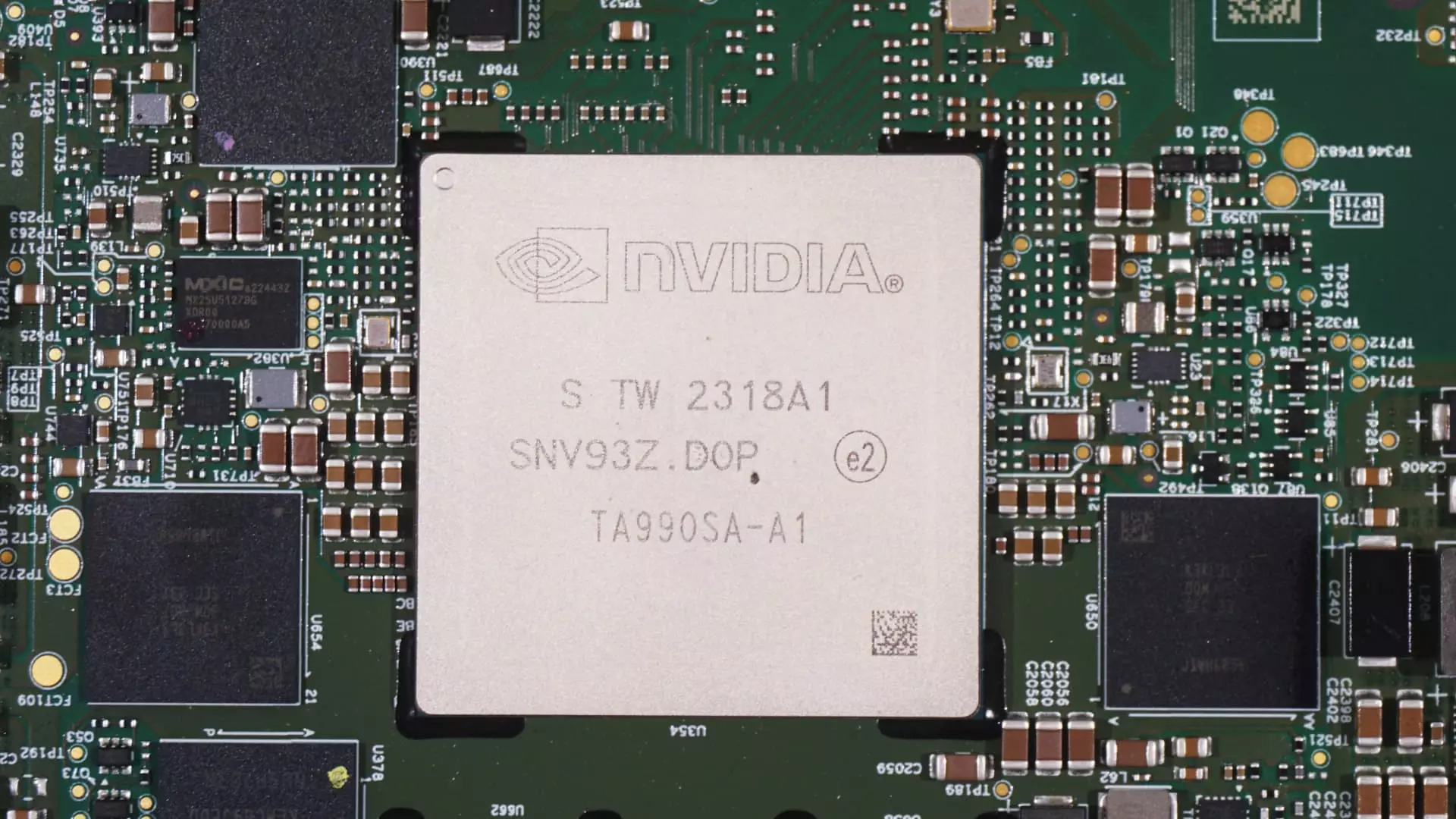

Interestingly, the week’s biggest winners emerged from an unexpected sector—semiconductors. Companies like Broadcom and Nvidia defied the odds, witnessing considerable rebounds fueled by positive headlines and market sentiment. The gains are indicative of investor behaviors that lean heavily on recovery psychology; when a sector or stock is perceived to be at rock bottom, it often prompts a rush to invest in the hope of a rebound.

However, these rallies should also be met with caution. While Broadcom’s stock buyback program and Nvidia’s strategic positioning regarding their AI chips suggest a resilient outlook, one cannot ignore the broader economic conditions that may stifle growth. The ongoing uncertainty about trade and tariffs looms large over these companies. What was once seen as a promising trajectory now finds itself susceptible to external shocks.

Next Steps for Investors

As we look ahead, the coming week will unveil additional corporate earnings and essential economic data. Reports on retail sales and import/export prices will offer insights that can influence the general market tone. Investors should remain vigilant, using these indicators to inform decisions rather than react hastily to market volatility.

There’s a delicate balance to achieve—one that combines optimism with a grounding in reality. The extreme swings we are currently witnessing are indicative of an irrational market environment that rewards quick-fix solutions while punishing long-term strategies. In light of this chaos, it may benefit investors to revisit their portfolios from both psychological and financial perspectives.

When emotion drives decisions in investing, it can cloud judgment and lead to missed opportunities. The critical task is to develop an investment strategy that incorporates not only quantitative data but also a robust understanding of market psychology and global events. In doing so, investors will be better equipped to navigate future uncertainties without falling victim to the whims of panic-driven trading.

By cultivating a center-wing liberal approach to investment—one that advocates for thoughtful engagement with both market forces and social responsibilities—investors can begin to see beyond mere numbers and formulate a strategy that acknowledges the collective human experience of investing.