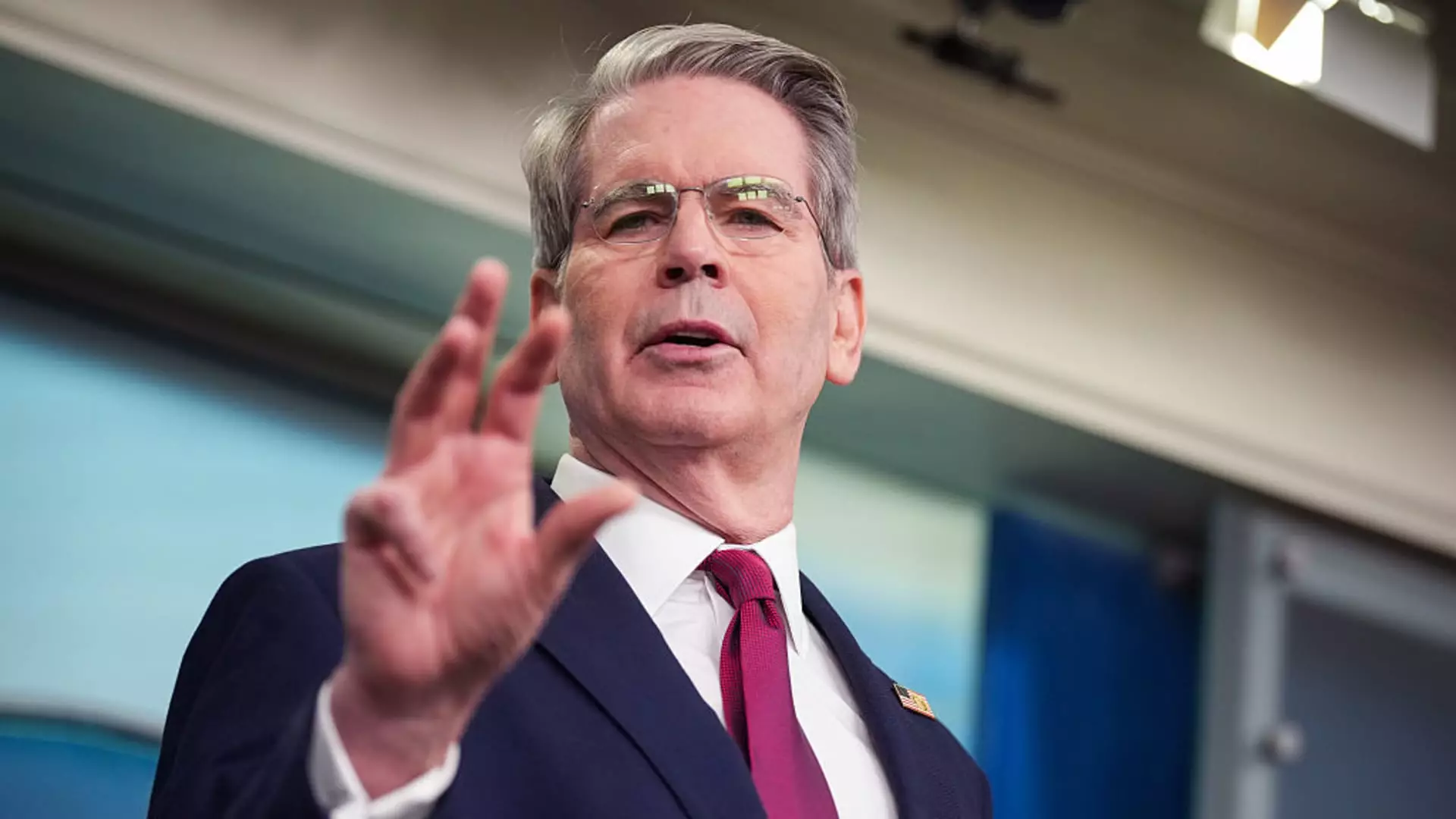

In an era where financial decision-making has become increasingly complex and volatile, Secretary of the Treasury Scott Bessent’s recent statements illuminate a fascinating dichotomy among investors. While institutional investors appear to be succumbing to panic at the prospect of President Trump’s aggressive tariff policies, individual investors seem unwavering in their confidence. Bessent’s assertion, backed by data from Vanguard that claims a staggering 97% of Americans have resisted trading amid market chaos, raises questions about the underlying motivations driving this collective inaction. Are individual investors exhibiting a commendable level of conviction, or are they merely riding a reckless wave of blind faith?

The Specter of Tariffs and Market Reactions

The truth is, the market’s response to Trump’s tariffs has been nothing short of tumultuous. Shortly after the announcement and subsequent suspension of tariffs—heralded as a significant moment in trade policy—the S&P 500 experienced its steepest decline since the onset of the COVID-19 pandemic. As retail investors hurried to nab stocks at discounted prices, fearing a classic “buy the dip” scenario, institutional investors likely weighed the impending economic repercussions more heavily. The striking drop now prophecies a closer look at the looming recession as economists, including Apollo’s Torsten Slok, predict trade-related shortages that could ultimately dampen consumer confidence. What does it mean that while one group capitalizes on opportunity, the other succumbs to dread?

A Fragile Trust in Leadership

Bessent attributes the steadfastness of individual investors to their faith in Trump’s policies. However, can such unwavering trust endure the predictions of economic slowdown? The notion that individual investors remain committed, while their institutional counterparts reel in fear, speaks volumes about the polarized views incited by current events. Is it reasonable to credit this belief solely to the president’s rhetoric, or are individual investors simply choosing not to engage with the broader economic indicators that suggest doom may be looming?

The Potential Fallout: A Brand at Risk

Ken Griffin, CEO of Citadel, articulates a compelling prospect: Trump’s trade tactics could jeopardize the United States’ global brand. Trade wars stress relationships with international partners and can foster an environment of distrust, which is counterproductive in a globally interconnected economy. As consumerism suffers from trade disputes, one begins to wonder if those retail investors backing these policies will reconsider their positions when they face empty shelves and rising costs.

To stake a claim on the market while sidelining the potential repercussions could be a gamble that few are willing— or should be willing—to take. The stakes are high, and while it’s commendable to show resilience, riding the trend without a discerning eye could lead to an abrupt awakening when the ramifications of tariffs finally set in. Are we witnessing brave optimism, or is it merely a façade hiding the apprehensions of future financial fallout? Only time will tell, but as evidenced by the testimonies of economists and market analysts alike, this unwavering optimism may soon face a reckoning.