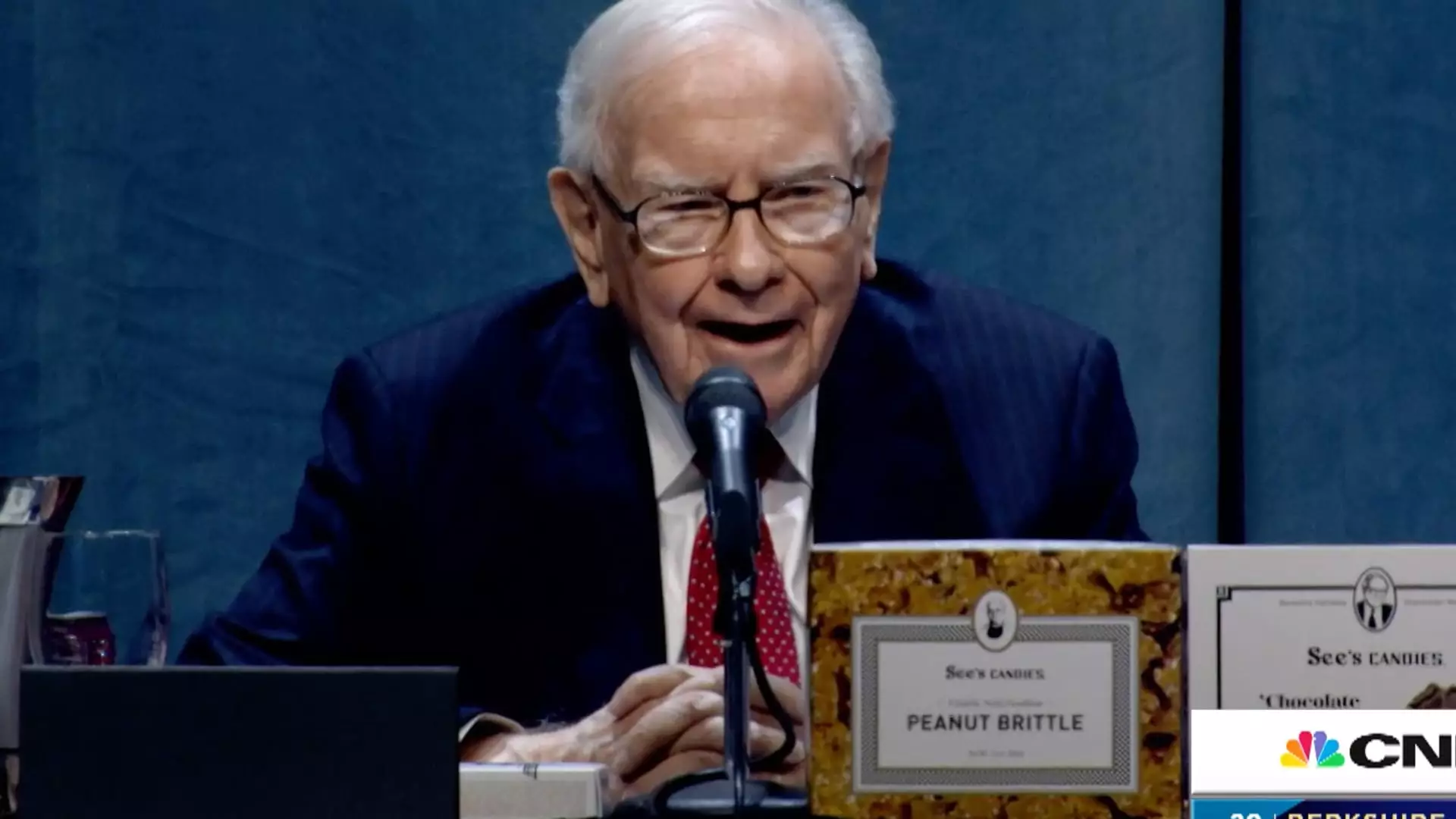

Warren Buffett, a heavyweight in the investment realm and the face behind Berkshire Hathaway, has seldom weighed in on political discourse, especially when it comes to tariffs imposed by heads of state. However, his recent comments regarding President Donald Trump’s tariffs have caught the attention of economists, investors, and the public alike. In a rare interview with CBS News, Buffett spoke frankly about the consequences of imposing tariffs, referring to them as a type of “economic warfare” that can ultimately burden consumers. His perspective shines a light on the deep-seated impacts of such measures, urging us to consider not only the immediate effects but also the long-term repercussions they may hold for the economy.

Buffett humorously pointed out that tariffs essentially act as a tax passed onto consumers, coining the notion that “the Tooth Fairy doesn’t pay ’em!” This tongue-in-cheek remark starkly highlights the irony behind tariffs; while they may be framed as protective measures for domestic industries, the reality is that they inevitably inflate prices for the average consumer. Structural inefficiencies often arise from elevated tariffs, creating a domino effect that can lead to increased costs across various sectors of the economy. The question Buffett raises—”And then what?”—is crucial because it underscores the need to consider the broader economic implications of protectionist policies.

Buffett’s analysis aligns with the heightened volatility seen in stock markets, particularly with the S&P 500 exhibiting stagnant growth and a mere 1% increase for the year. His avoidance of comment on the current economy during the interview hints at a cautious outlook, reflective of the uncertainty surrounding trade policies and their potential ripple effects on economic stability. By shedding light on the fragility of economic structures under aggressive tariff measures, Buffett presents a case for prudence and strategic thinking, especially in turbulent times when market dynamics can shift unexpectedly.

The past year has witnessed Buffett adopting a decidedly defensive strategy, as evidenced by his notable divestiture from numerous stocks while simultaneously amassing significant cash reserves. This shift has led to speculation regarding his intentions—some view it as a bearish signal about the economy’s future, while others believe he is strategically positioning Berkshire Hathaway for a seamless transition to his eventual successor. Regardless of the interpretation, his actions suggest an acute awareness of unpredictable policy changes and the pressures stemming from a slowing economy. There is wisdom in his restraint, as he prepares his conglomerate to weather potential storms.

Warren Buffett’s remarks on tariffs reveal the complex nature of economic policies and their implications for consumers and the broader market. His call for careful examination of the consequences behind such policies is critical, especially as governments around the world grapple with balancing domestic interests and global trade relations. Buffett’s insights serve as a reminder that the decision-makers at the helm of economic policy must proceed with caution, keeping the enduring impact on everyday consumers and the overall economic health in mind. In a world where economic landscapes are perpetually shifting, the lessons gleaned from Buffett’s analysis are more pertinent than ever.