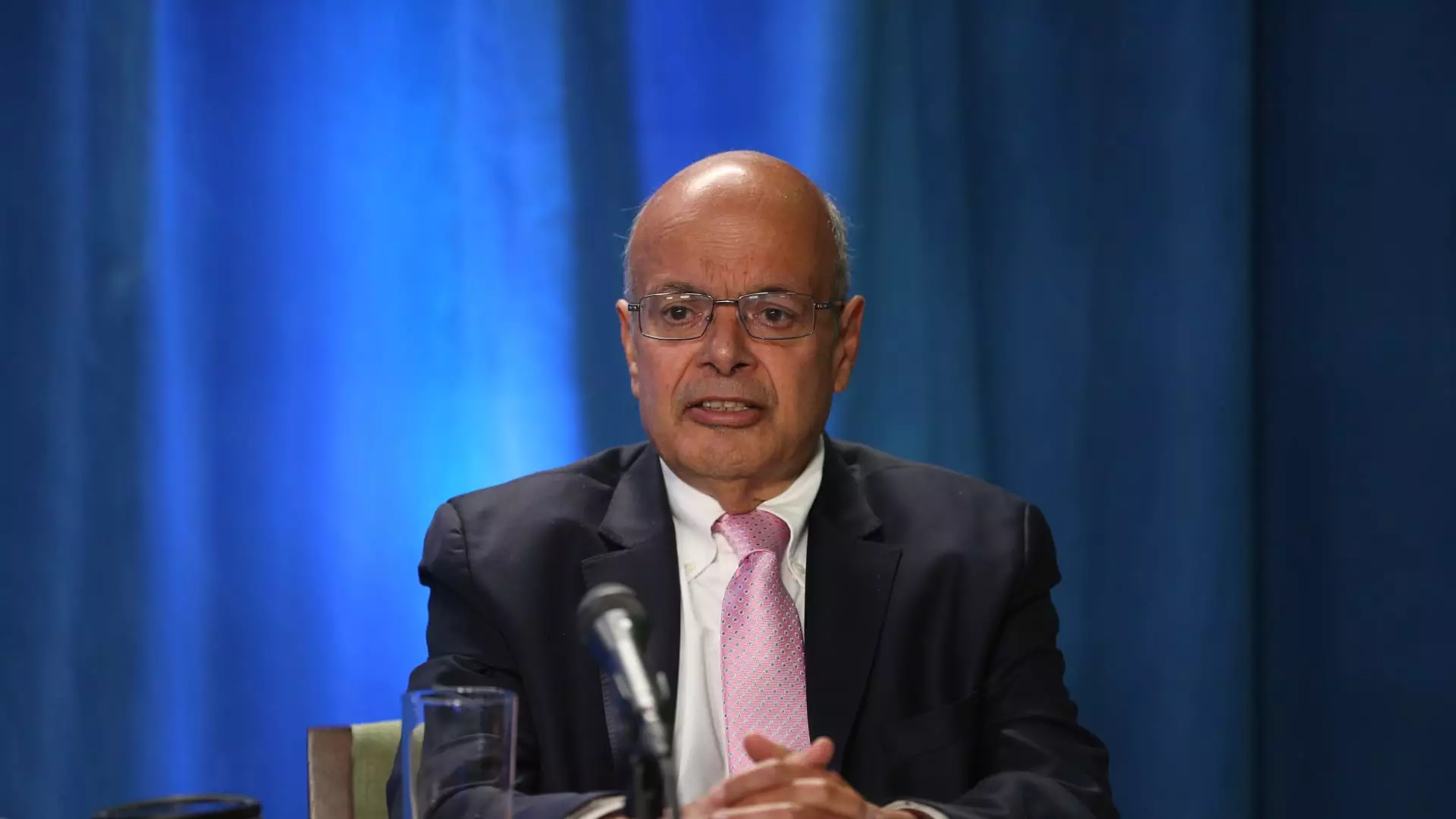

In an unexpected move, Ajit Jain, the vice chairman of Berkshire Hathaway’s insurance operations, recently divested more than half of his stake in the conglomerate. This decision, marked by the sale of 200 Class A shares at a significant average price, has sent ripples through the financial community, prompting analysts and shareholders alike to reassess both Jain’s motivations and the broader implications for Berkshire Hathaway.

The regulatory filing unveiled that Jain sold these shares for approximately $139 million, leading him to retain merely 61 shares in his own portfolio. Additionally, he controls family trusts that hold another 55 shares and a nonprofit foundation that contains 50 shares, which belies his robust connection to the conglomerate. This recent transaction accounted for a substantial 55% reduction in Jain’s overall holdings, marking a historic decline since he joined Berkshire Hathaway in 1986. Such a drastic move from a key executive raises the question of what underlying factors spurred the sale.

Jain’s sale coincides with a period of heightened stock prices for Berkshire Hathaway. With shares climbing to over $700,000 and the company achieving a market capitalization exceeding $1 trillion by the end of August, it appears that Jain capitalized on a peak valuation. Market analysts, like David Kass from the University of Maryland, suggest this could indicate Jain’s perspective that Berkshire’s stock is now fully valued. When major shareholders begin to divest during peak market conditions, it often serves as a cautionary signal for potential investors—suggesting that shares may be overvalued and not a cheap investment at current rates.

This strategic sale also arrives amidst a noticeable slowdown in Berkshire Hathaway’s share buyback activities. During the second quarter, the conglomerate repurchased only $345 million in shares, which starkly contrasts with the $2 billion repurchases made in previous quarters. Experts, including Bill Stone from Glenview Trust Co., argue that this deceleration in buybacks potentially signals that the stock is not particularly attractive at current valuations. Given that Berkshire’s shares hover around 1.6 times book value, many believe they approach Warren Buffett’s conservative estimates of intrinsic value, reiterating that the stock is presumably not “cheap.”

Ajit Jain’s role at Berkshire Hathaway is historied and formidable. His contributions to the reinsurance sector and the operational rejuvenation of Geico—one of Berkshire’s most prized assets—have established him as a pivotal force in the corporation’s flourishing narrative. Warren Buffett himself has lauded Jain’s capabilities, stating in a 2017 letter that if given a chance to swap leadership with him, he would not hesitate. Such praise underscores Jain’s value to the firm, making his recent share sale even more intriguing.

However, with speculation swirling regarding who will take the reins post-Buffett, Jain has remained steadfast in his intentions. Despite rumors linking him to a potential succession, Buffett has clarified that Jain “never wanted to run Berkshire.” Thus, this product narrative becomes layered, nurturing the intrigue surrounding both Jain and the future of Berkshire Hathaway itself.

Ultimately, Ajit Jain’s recent stock sale is a multifaceted development that extends beyond a mere financial transaction. It raises significant questions about market valuations, strategic investment positioning, and the long-term vision for Berkshire Hathaway. Investors may interpret this as a precautionary measure, while simultaneously honoring Jain’s legacy as a transformative leader within one of the world’s most successful corporations. As the market watches these developments unfold, Jain’s decisions could well influence investor sentiment and the strategic direction of Berkshire Hathaway for years to come.