Oracle Corporation is experiencing an exhilarating surge in its stock value, with shares climbing approximately 6% in after-hours trading following the company’s announcement of an optimistic revenue outlook for fiscal 2026. At a pivotal analyst meeting during the Oracle CloudWorld conference in Las Vegas, the tech giant revealed projections that place its anticipated revenue for fiscal 2026 at a minimum of $66 billion, surpassing expectations set by market analysts, who had forecasted only $64.5 billion. This bullish sentiment is a reflection of the company’s ongoing resilience and growth trajectory, registering a remarkable 15% increase in shares over the past three trading days, lifting its stock price to record highs.

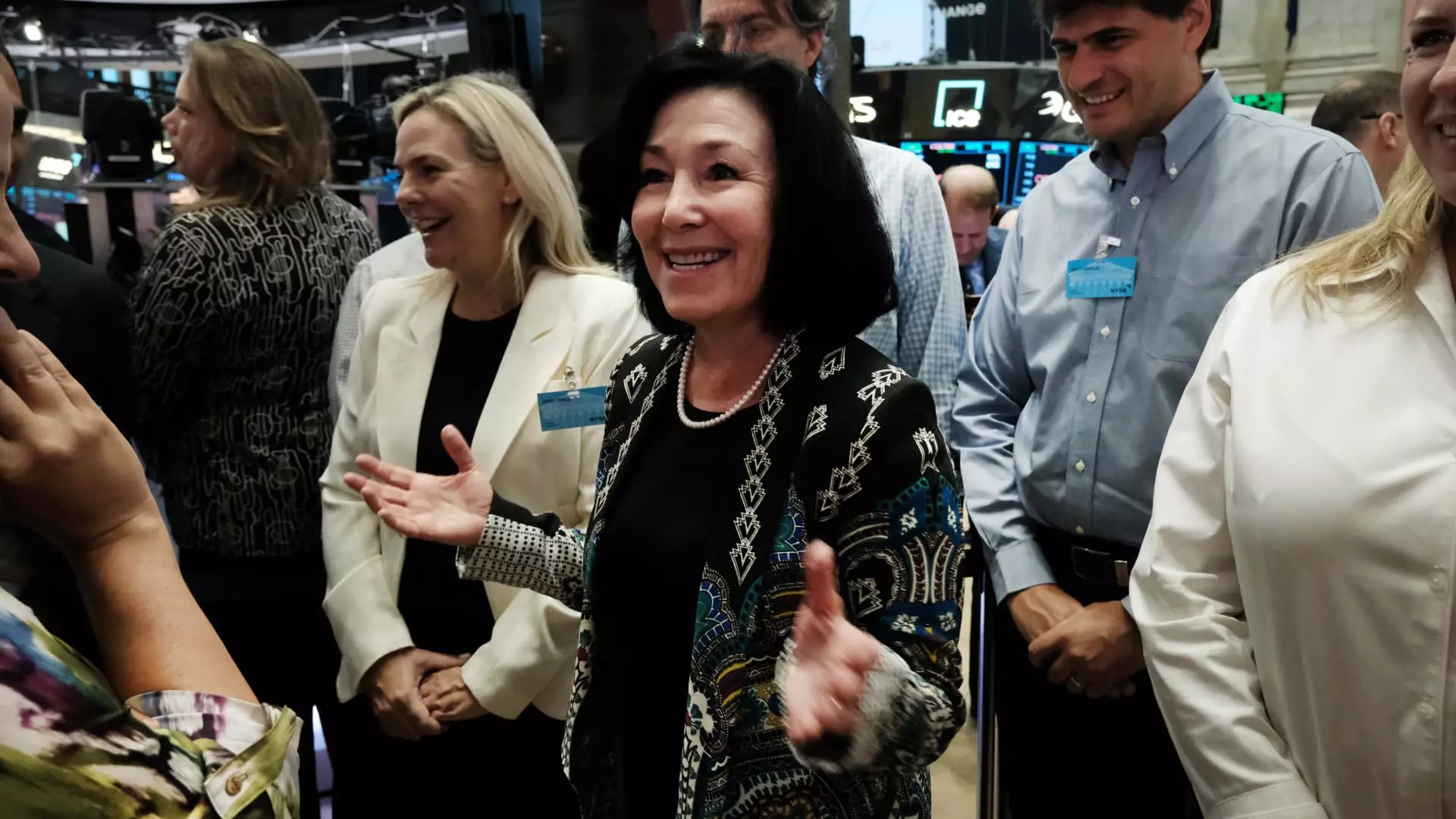

The company’s overall performance in 2023 stands out, with Oracle shares surging 55% year-to-date, second only to the impressive gains of Nvidia in the large-cap tech sector. Indicative of a transformative approach, Oracle is keenly focused not just on immediate results but also on its long-term vision. During the conference, CEO Safra Catz emphasized the significance of strategic partnerships, particularly with leading cloud providers such as Amazon, Google, and Microsoft, which will allow organizations to seamlessly utilize Oracle’s database solutions. Their recent partnership with Amazon, unveiled earlier in the week, exemplifies this strategy and is expected to enhance the company’s market penetration.

A critical component of Oracle’s remarkable growth is attributed to its cloud infrastructure, which demonstrated an impressive 45% increase in revenue during the last quarter. This growth rate not only outpaces that of competitors like Amazon, Google, and Microsoft but also underscores the shifting tide towards cloud computing as businesses migrate their operations away from conventional data centers. Additionally, Oracle is positioning itself to capitalize on the burgeoning field of artificial intelligence. The recent announcement that its cloud unit has commenced orders for over 131,000 next-generation “Blackwell” GPUs from Nvidia illustrates the company’s commitment to integrating advanced technologies into its services.

As Oracle eyes ambitious growth, it intends to significantly increase its capital expenditures, anticipating a doubling in the 2025 fiscal year. Such investments are crucial for sustaining the momentum in revenue generation capabilities and technological innovation. With projected revenues soaring to over $104 billion by fiscal 2029, accompanied by an expected 20% year-over-year growth in earnings per share, it seems no challenge is insurmountable for Oracle. Safra Catz’s confidence in achieving these targets reflects the company’s robust strategic planning and execution.

Oracle’s recent performance coupled with its optimistic outlook signals a transformative phase for the company. With strong revenue projections, innovative partnerships, and aggressive investment strategies, Oracle is poised to not only sustain its current growth but also to thrive in a competitive tech landscape. The road ahead appears promising, paving the way for continued success in both cloud services and artificial intelligence integration.