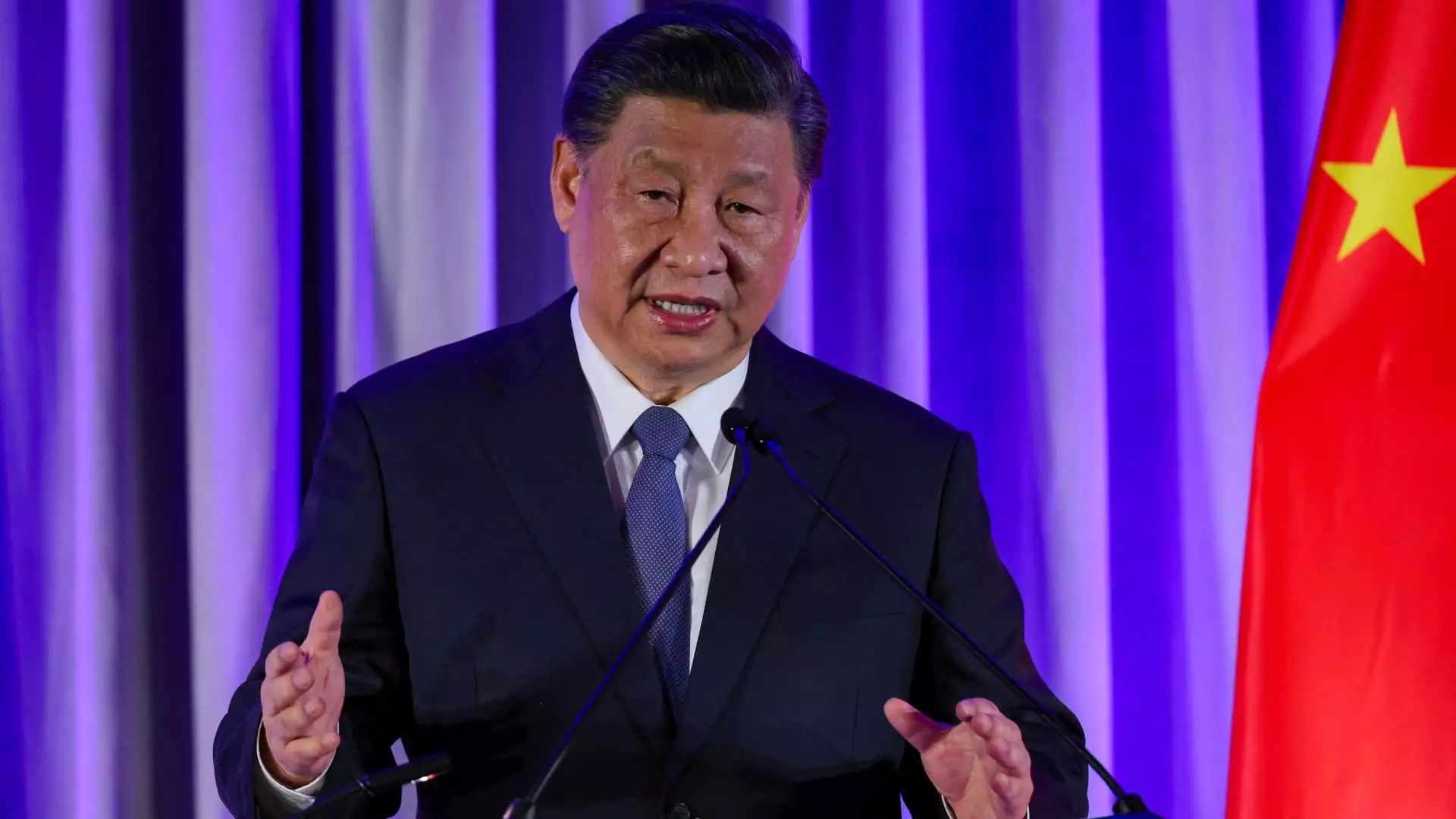

In a decisive move aimed at stabilizing its faltering economy, China’s top leadership convened a high-level meeting under the supervision of President Xi Jinping. Released by state-run media, the meeting underscored the urgency to curb the decline of the real estate market, a sector that has been pivotal in driving China’s economic growth over the years. With numerous challenges compounded by the global economic landscape, the Politburo acknowledged the pressing need to respond to public apprehensions while also fostering a stable recovery of the housing sector.

Over the last few years, the real estate market in China has experienced a significant slump, exacerbated since the government’s crackdown in 2020, which targeted developers for excessive debt. This crackdown has not only impacted the real estate sector but has also led to a decline in local government revenues and household wealth. In turn, this downturn has adversely affected China’s broader economic growth, raising concerns about its ability to meet its GDP target of approximately 5% for the full year. Analysts are keenly aware that, without targeted stimulus measures, reaching these goals may prove to be increasingly challenging.

Small signs of recovery have emerged; for example, recent official data indicates a slight moderation in the decline of real estate sales, with a reported 23.6% decrease in new home sales year-on-year as of August. However, average home prices continue to be under pressure, with a noted decline of 6.8% in August, down from 7.6% the previous month, according to Goldman Sachs. This fluctuation raises a critical question: how can the government stoke demand in a market plagued by uncertainty and a lingering wait-and-see attitude among homebuyers?

During the important meeting, authorities emphasized the necessity of enhancing fiscal and monetary policy frameworks. With the intention of invigorating the real estate market, plans include limiting housing supply growth, augmenting loans for select projects, and easing the burden on existing mortgage holders. The People’s Bank of China has signaled potential interest rate cuts aimed at reducing the financial strain on homeowners, estimating that these measures could alleviate mortgage costs by approximately 150 billion yuan ($21.37 billion) annually.

This strategic pivot highlights a shift away from simply propping up property prices and instead focuses on revitalizing real estate demand by encouraging household purchases and breaking the stagnation cycle. As pointed out by Yue Su, a principal economist from the Economist Intelligence Unit, the priority is not merely to bolster wealth through rising prices but to instill confidence in purchasers to stimulate the economy.

The reading of the Politburo meeting resulted in positive repercussions within stock markets, manifesting as gains in both mainland China and Hong Kong—with property stocks experiencing a notable surge of nearly 12%. This market response may indicate a growing optimism towards government support in real estate, which historically played a substantial role in propelling China’s economic engine.

However, not all analysts share the same level of optimism. While some anticipate a forthcoming wave of proactive policies, others remain skeptical, warning that the meeting’s announcements lacked clarity on the scale of potential fiscal support. A nuanced approach appears to be a priority for policymakers, striking a balance between immediate stabilization and addressing underlying structural issues within the economy. Bruce Pang, the chief economist at JLL, noted that the directive from the Politburo to “work hard to complete” economic targets reflects a more tempered stance than in previous meetings.

As China aims to navigate through these challenges, the overarching theme remains clear: a shift in focus from growth at all costs to a sustainable, quality-focused economic model. With forecasters adjusting GDP growth expectations downward, it becomes increasingly crucial for the government to adopt a pragmatic approach that embraces both short-term stabilization and long-term, resilient growth frameworks.

While the recent Politburo meeting demonstrates a proactive pivot towards addressing the housing market crisis, analysts remain divided over the implications of the new policy directives. Navigating this turbulent economic landscape will require careful, strategic maneuvering from the Chinese government as it seeks to foster public confidence while also safeguarding its broader economic objectives. The trajectory of China’s recovery will hinge on its ability to implement these measures effectively amid ongoing global uncertainties.