In a recent discussion surrounding potential investments, financial expert Jim Cramer has put the spotlight on BlackRock, the largest asset management firm globally. Highlighting its impressive trajectory, Cramer has included BlackRock on the “Bullpen” list—a collection of stocks that are currently under consideration for investment. The timing of this recommendation is critical, as BlackRock’s stock price has surged to unprecedented heights following a stellar third-quarter earnings release that surpassed analyst predictions by a wide margin.

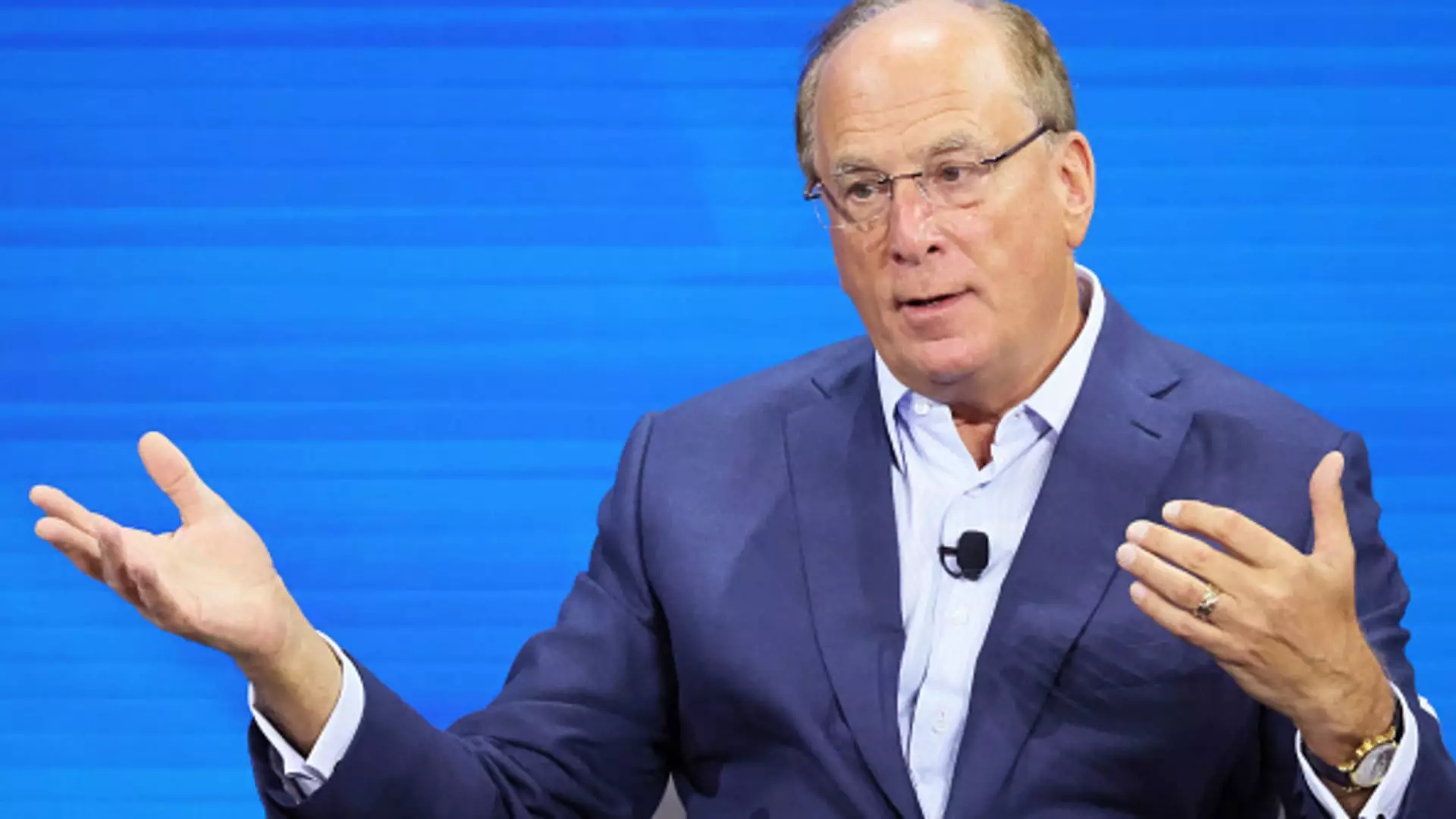

BlackRock’s third-quarter report revealed a significant milestone—assets under management soared to an astounding $11.5 trillion. The surge in assets is indicative of not just momentary market fluctuations but reflects a robust and ongoing inflow of investments as the stock market rallied. CEO Larry Fink articulated this achievement during a CNBC interview, noting that BlackRock has organically added $2 trillion in assets over the last five years alone. To put this number into perspective, this increase positions BlackRock alongside the world’s sixth largest asset managers based solely on organic growth.

Fink also announced the successful acquisition of Global Infrastructure Partners for $12.5 billion, a strategic move that further expanded their asset base by over $100 billion. Such acquisitions are instrumental in not only boosting the company’s asset portfolio but also in reinforcing its position in an increasingly competitive landscape.

The financial sector is currently navigating a complex economic environment characterized by fluctuating interest rates. The Federal Reserve’s actions have been particularly influential, with markets anticipating possible adjustments in rates. The recent cuts have modified expectations about future rate movements; while some analysts initially projected multiple high-impact reductions, the sentiment has now shifted towards a more tempered forecast.

In this turbulent backdrop, BlackRock’s solid performance stands out. It provides a beacon of stability and growth potential, contrasting with the volatility that other financial institutions are encountering. Companies like Wells Fargo and Morgan Stanley have also released commendable earnings reports, but BlackRock’s results are noteworthy due to their sheer scale and consistency.

Given BlackRock’s impressive upward trajectory—evidenced by a 12% rise in stock price over the past month compared to the S&P 500’s modest 4% increase—Cramer’s team finds itself at a critical juncture. While Jim acknowledges that BlackRock’s shares have already experienced substantial growth, he believes there remains considerable potential for further appreciation.

The decision to wait before committing to BlackRock stems from a cautious investment philosophy. Cramer has been focusing on other stocks within his portfolio, specifically Wells Fargo and Morgan Stanley, which necessitates a measured approach to portfolio management. As a result, the strategy involves waiting for the opportune moment to act, adhering to the principle of not hastily making moves in an unpredictable market.

BlackRock’s recent performance underscores its significance in the current financial market. The firm’s ability to not only weather the economic storm but thrive within it speaks volumes about its leadership and strategic direction under Fink. Its extensive asset base and innovative growth strategies position it well for the future, earning it a rightful place among stocks that warrant close attention.

Jim Cramer’s Investing Club continues to analyze opportunities, providing guidance and insight to its subscribers. As they contemplate the merits of adding BlackRock to their portfolio, it reflects a broader trend of identifying resilient companies capable of leveraging market dynamics to enhance shareholder value. As the financial landscape evolves, so too will the opportunities, and firms like BlackRock are poised to navigate this changing terrain with agility and expertise.