As Nvidia gears up to announce its fiscal third-quarter earnings, scheduled for the end of the trading day on Wednesday, the financial world is abuzz with speculation and analysis. Wall Street’s consensus estimates, compiled by LSEG, project revenue to reach an impressive $33.16 billion, alongside an adjusted earnings per share of 75 cents. While these figures are indeed noteworthy, the more pressing question for investors concerns Nvidia’s outlook for the future, particularly in light of the ongoing artificial intelligence (AI) growth cycle that has captivated numerous sectors over the past couple of years.

Growth Amidst a Changing Landscape

The heart of the matter lies in whether Nvidia can maintain its aggressive growth trajectory. As the AI boom enters its third year, the expectations for Nvidia are high. Analysts predict the company will provide guidance of 82 cents per share on sales that could soar to $37.08 billion. Achieving such ambitious targets hinges significantly on the success of Blackwell, the company’s cutting-edge AI chip designed specifically for data center applications, which is reportedly already being shipped to major players like Microsoft, Google, and Oracle. This should ideally position Nvidia as a leading innovator in the rapidly evolving tech landscape.

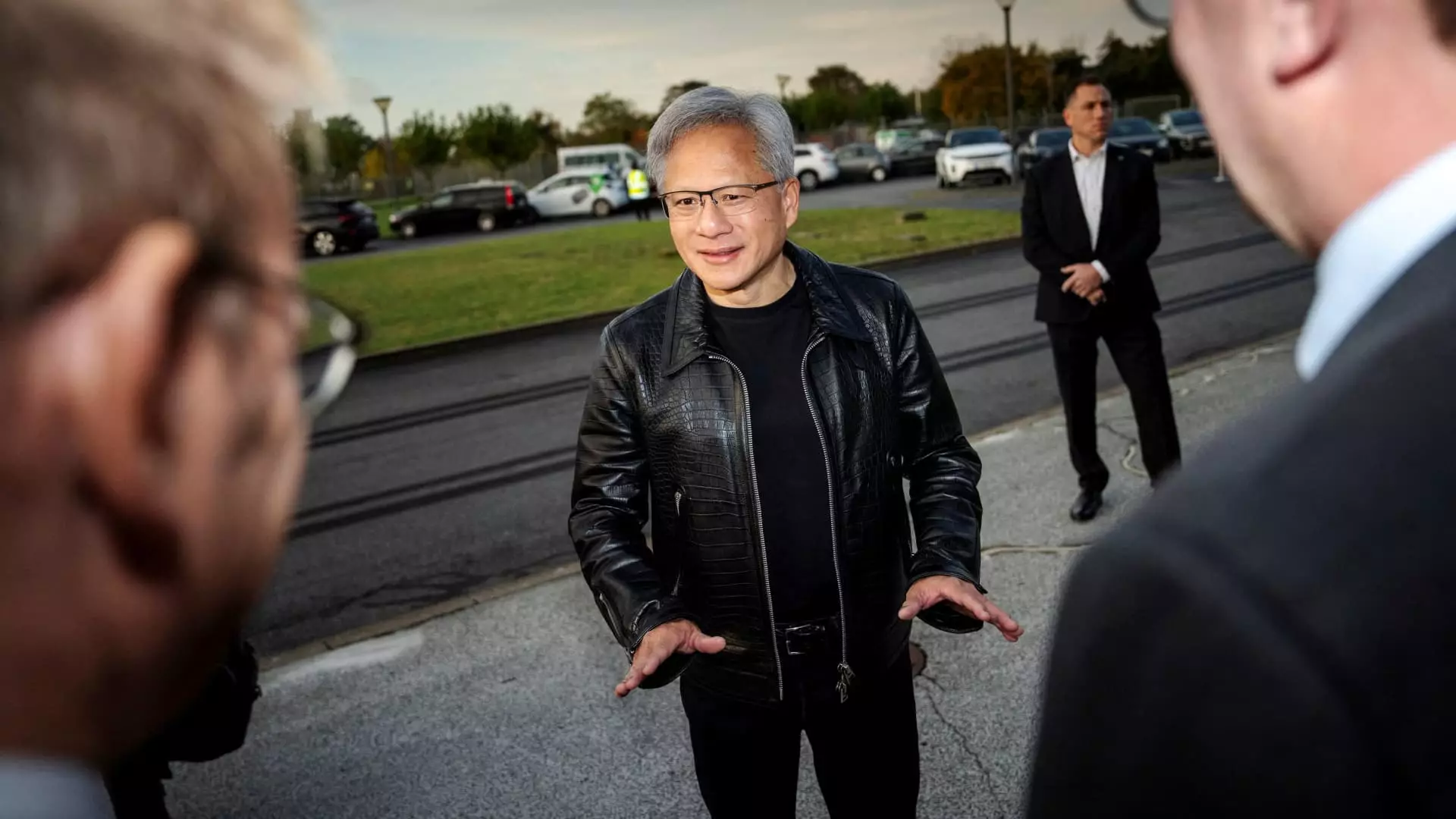

Investors will be especially attentive to CEO Jensen Huang’s remarks regarding the demand for Blackwell chips. Understanding whether the current demand can support the ambitious revenue forecasts will be critical. Furthermore, recent reports suggest escalating concerns over overheating issues experienced by some systems utilizing Blackwell chips. Addressing these technical challenges will be crucial for maintaining investor confidence and ensuring sustained growth. During a prior earnings report, Nvidia projected that it would generate “several billion” dollars in Blackwell-related sales in the following January quarter, which lends weight to the significance of this new product line.

Nvidia’s stock has seen remarkable growth, nearly tripling in value since the start of 2024. However, while the company reported a staggering 122% increase in sales during its most recent quarter, this figure is a substantial decrease compared to the extraordinary growth rates of 262% and 265% recorded in the prior two quarters of the year. This slowdown prompts a sense of caution, as investors grapple with the reality that hyper-growth phases often subject companies to volatility and market correction.

Nvidia stands at a critical juncture as it prepares to release its quarterly earnings. Investors are not merely looking for numbers; they are searching for insights that will help them gauge the company’s resilience and adaptability in a highly competitive market. The outcomes of this earnings report will likely offer a glimpse into how Nvidia plans to navigate the evolving demands of AI and the tech industry while managing potential pitfalls with its new product lines. As the company continues to leverage its pioneering technology, how it communicates its strategy and addresses existing challenges will be instrumental in determining its trajectory in the coming quarters.