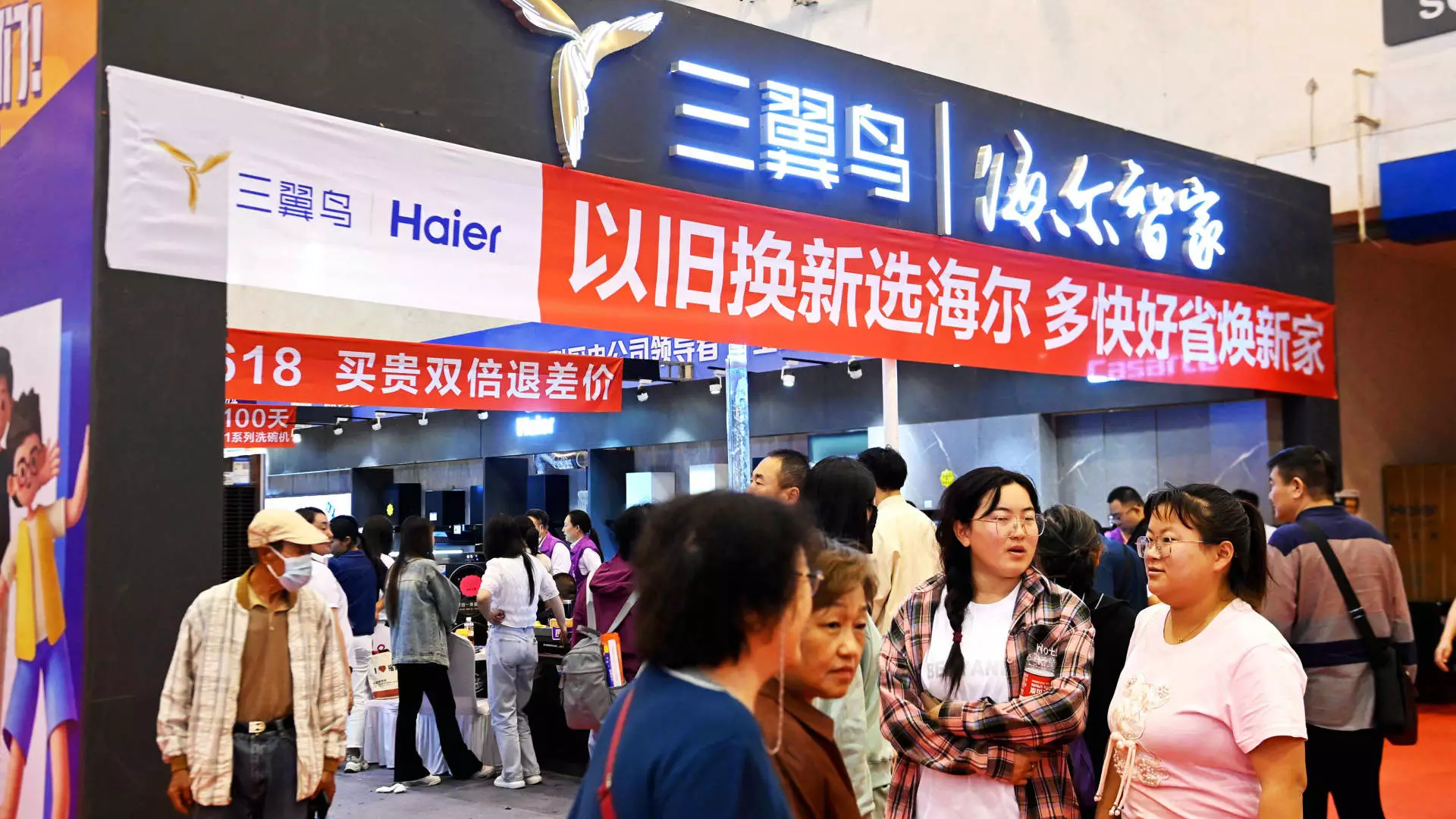

China’s recent economic strategies reflect an urgent desire to stimulate consumer spending and drive growth amidst signs of economic stagnation. In July, a landmark announcement revealed the allocation of 300 billion yuan ($41.5 billion) to fund trade-in programs aimed specifically at consumer goods and essential equipment upgrades. The government’s recognition of the need for consumption-driven economic revitalization comes as data highlights rising concerns over sluggish retail sales and looming domestic challenges. Analysts had anticipated that such bold fiscal moves could reignite consumer enthusiasm and spur a more active economic landscape.

However, while the intentions are robust, the practical impact of these policies remains uncertain, particularly concerning their direct influence on consumer behavior. This is essential to understand as China’s economy looks to rebalance from export reliance toward a consumption-based model. The trade-in strategy, which allows consumers to swap older goods for subsidies when purchasing new ones, theoretically should provide a financial incentive to make necessary upgrades, thereby stimulating spending.

Despite the government’s significant financial commitment, feedback from businesses indicates a notable lag in translating these policies into action. Jens Eskelund, president of the EU Chamber of Commerce in China, articulated a common frustration by stating, “We are not aware of companies that have seen this translate…into concrete incentives.” This implies a disconnect between the announcement of the initiative and its implementation at the ground level, raising questions about effective communication and execution among local authorities.

A critical aspect of these trade-in programs is the requirement for consumers to provide upfront payments and have usable goods to turn in. This stipulation may disproportionately affect lower-income households, thereby limiting the program’s overall reach and effectiveness. An analysis from the EU Chamber of Commerce estimated that the budget could translate to a mere 210 yuan ($29.50) per capita, suggesting a diluted impact on household consumption.

Additionally, market sentiment may still be marred by broader economic uncertainty, compelling consumers to be cautious with their spending, even when potential incentives are available. The tepid growth in retail sales—reported at just 2% in June—exemplifies the prevailing consumer apprehension, perhaps overshadowing the intended effects of the trade-in policy.

The Broader Economic Context

Industry experts’ outlook on the trade-in program’s potential to support retail sales remains limited, with estimates suggesting it may equate to only 0.3% of retail growth this year. This conservative projection underscores the prevailing sentiment that while the government aims to spur economic activity, substantial and immediate results may not be forthcoming.

Despite this, some sectors are experiencing growth that seems resistant to broader market trends. For instance, new energy vehicle sales surged by nearly 37% in July, showcasing a segment of the market where consumer interest is evidently more robust. This dichotomy highlights the complexity within China’s economy, where certain areas flourish while others languish.

The support for trade-ins is also reflected in significant subsidies offered for new energy vehicles and traditional fuel-powered cars. This dual approach emphasizes the government’s intent to shift not only consumption patterns but also to address environmental concerns. However, substantial challenges remain, as exemplified by the slow uptake of equipment upgrades, particularly highlighted by the elevator industry’s tepid response to the new policies.

For businesses looking to capitalize on the government’s initiatives, the incomplete rollout of the trade-in program presents both challenges and opportunities. As companies like Otis struggle with sales declines, the broader implications of sluggish consumer engagement become apparent. Executives express cautious optimism, noting that while local governments are showing interest in deploying centralized funding effectively, ambiguity regarding specific allocations and procedures could hinder efforts.

Moreover, companies engaged in processing secondhand goods suggest a potentially transformative longer-term impact from the government’s bond strategy. As evidenced by increasing trade-in activity on platforms like JD.com, there is a glimmer of hope that the growing acceptance of secondhand markets may parallel the implementation of trade-in policies. However, the extent to which this will provide meaningful economic lift is still in question.

As China navigates through these complex economic waters, stakeholders will need to refine policies, bolster effective communication, and foster consumer confidence, lest the ambitious fiscal measures fall short of their aspirational goals. The journey ahead is uncertain, yet the capacity for growth remains contingent on responsive measures that adapt to the evolving consumer landscape.