AppLovin Corporation, a formidable entity in online gaming and advertising, experienced an astonishing surge of 45% in its stock price on Thursday, showcasing its financial strength and future prospects. Following the release of better-than-expected earnings and revenue, the stock breathed life into investors’ portfolios, soaring past $245 during early afternoon trading. This impressive increase placed its year-to-date growth at an eye-popping 515%, eclipsing other technology firms valued at more than $5 billion. Such rapid growth propelled AppLovin’s market capitalization beyond $80 billion, capturing the attention of stakeholders and analysts alike.

Financial Performance and Future Projections

In the third quarter, AppLovin reported a significant 39% increase in revenue, reaching $1.2 billion, which easily surpassed the average estimate of $1.13 billion. Furthermore, its earnings per share of $1.25 significantly exceeded the consensus estimate of 92 cents. Looking ahead to the fourth quarter, the company projects revenue to lie between $1.24 billion and $1.26 billion—an anticipated growth of approximately 31% when evaluated at the midpoint. Analysts were optimistic yet cautious, projecting revenues closer to $1.18 billion. The financial landscape indicates that AppLovin’s performance is not merely a transient spike, with strong indicators of sustained growth on the horizon.

Founded a decade ago, AppLovin transitioned to a public entity in 2021, amidst a gaming boom fueled by the pandemic. While historically, the company’s game development unit operated with slow growth, the pivot towards a robust online advertising business has been a game changer. Specifically, innovations in artificial intelligence have catalyzed improvements in ad targeting, highlighting AppLovin’s focus on integrating technology into its business model. The introduction of the AXON advertising engine, particularly the 2.0 version released last year, has been a focal point of this growth. This platform adeptly increases the precision of advertisements across mobile gaming applications, benefiting not only AppLovin’s owned properties but also other client studios that utilize the software.

Amidst remarkable revenue increases, Wall Street’s keen fascination with AppLovin lies in its escalating profitability. Net income surged by an astonishing 300%, translating to $434.4 million in this quarter alone—up from $108.6 million—a compelling narrative of transformation. The software platform’s adjusted profit margin stood at a striking 78%, further validating AppLovin’s business model and efficiency. Analysts from Wedbush have taken note of these developments, advocating for the stock, raising their price target from $170 to $270, painting a bullish picture for investors.

The Path Ahead: E-Commerce Innovations

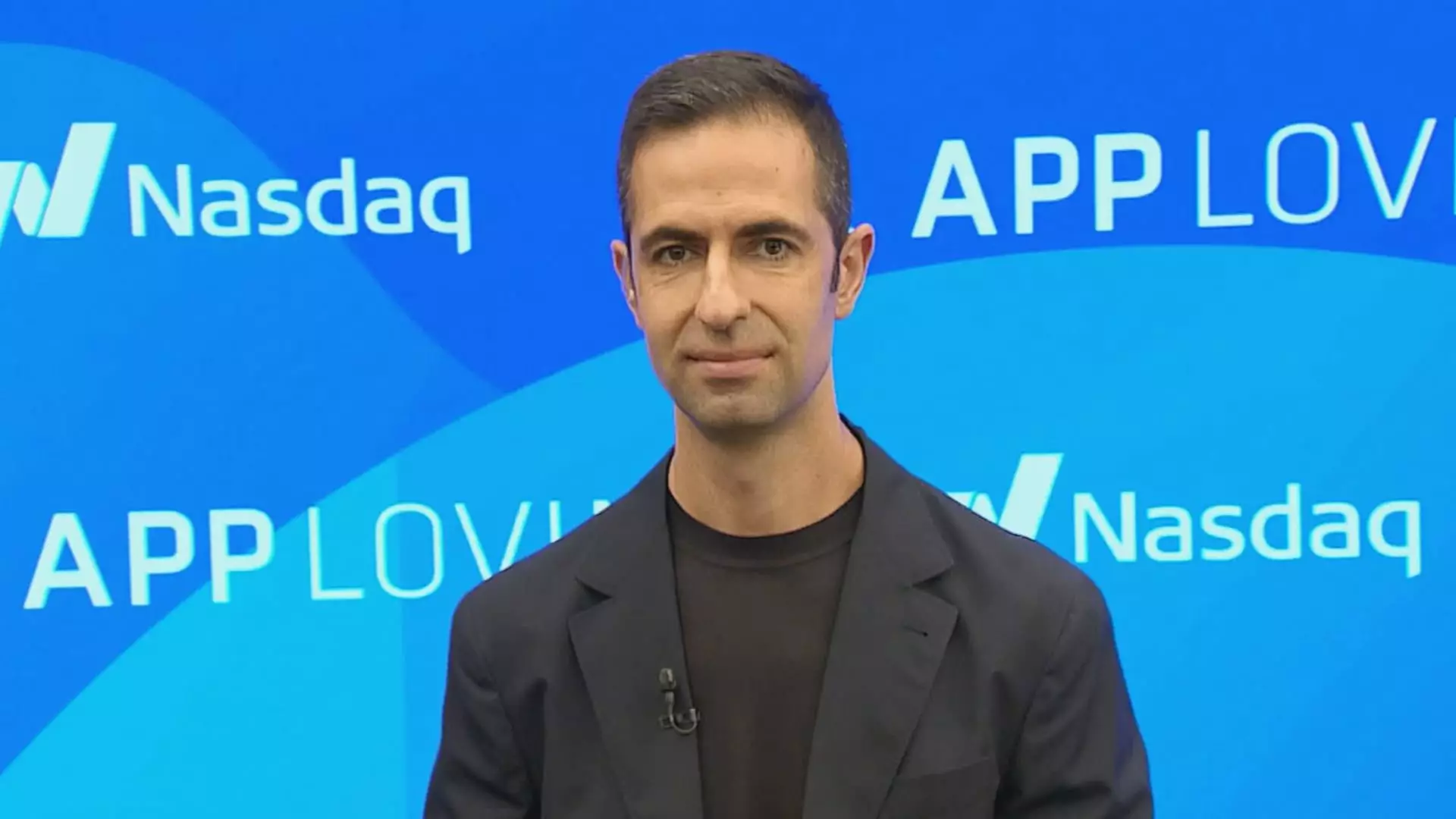

CEO Adam Foroughi highlighted that his net worth ballooned significantly post-reporting—exceeding $7.4 billion, with a substantial increase attributable to the company’s promising future. Foroughi also briefed stakeholders on a pilot e-commerce initiative designed to integrate targeted advertising directly within gaming platforms. This innovation represents one of the most exciting products introduced by AppLovin to date. His conviction in the e-commerce venture underscores the company’s commitment to staying ahead of industry trends while diversifying its revenue streams.

AppLovin’s dramatic growth reflects not only its impressive financial results but also its strategic use of technology to adapt and thrive in a continually evolving landscape. The favorable projections, coupled with advancements in AI and e-commerce, suggest that AppLovin is poised for even greater achievements in the near future.