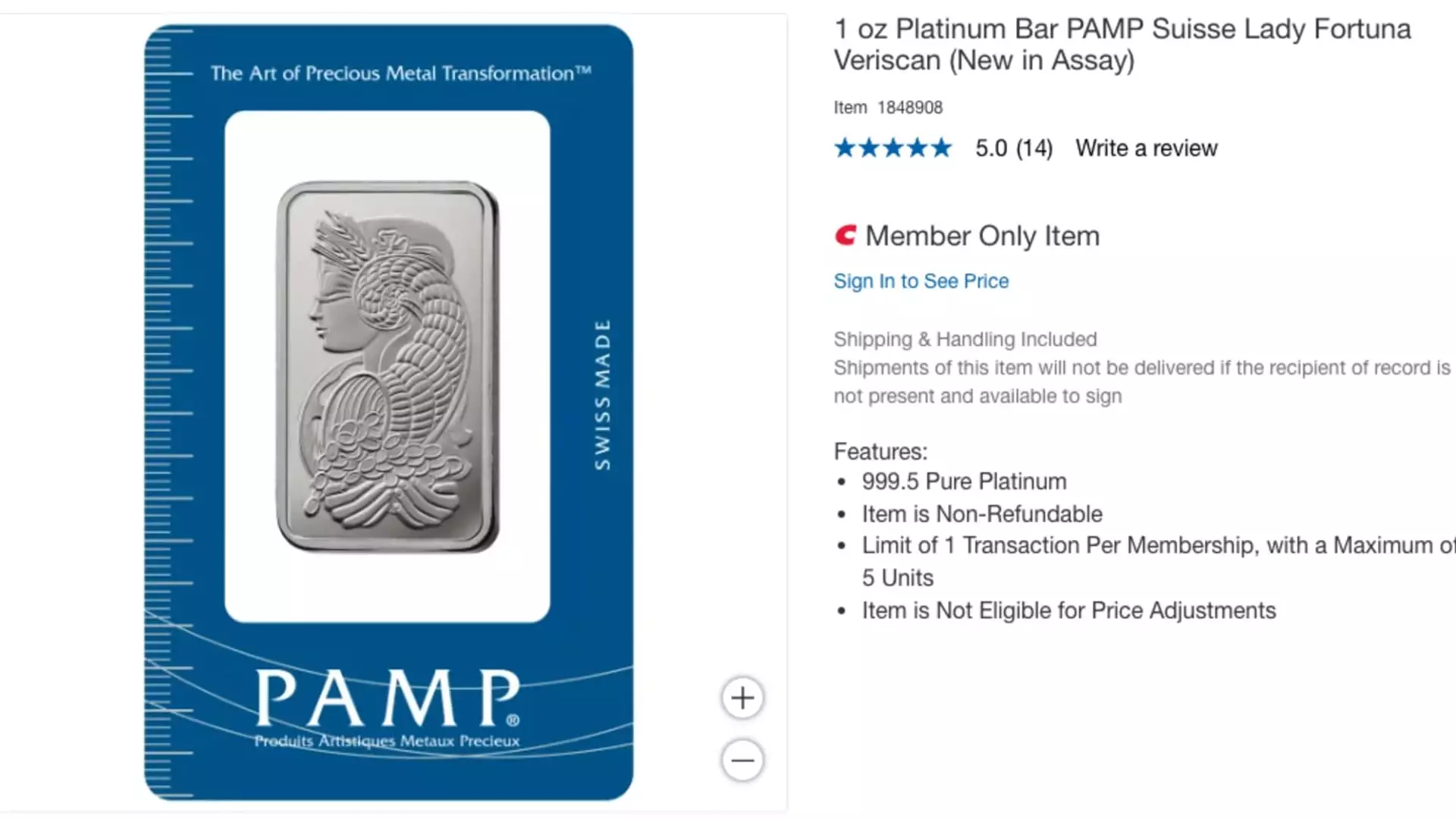

Costco has made a noteworthy entry into the precious metals market by adding Swiss-made platinum bars to its existing inventory of gold bars and silver coins. Priced at $1,089.99 each, these newly introduced 1-ounce platinum bars are available exclusively for online purchase. However, potential buyers from Louisiana, Nevada, and Puerto Rico will find themselves unable to have these bars delivered due to company restrictions. That said, access to these valuable items hinges on holding a Costco membership, which ranges from $65 to $130 annually. This strategic expansion not only signifies Costco’s commitment to diversifying its product lines but also reflects growing consumer interest in precious metals as viable investment options.

Costco’s foray into the world of precious metals is no mere whim; it is grounded in solid market trends. Having successfully launched gold bars in August 2023, the company has seen immense popularity, with gold bars vanishing from inventory within hours of restocking. Recent reports from analysts at Wells Fargo indicate that Costco is moving a staggering $200 million worth of gold bars each month—a clear indication of the product’s appeal among its members. The excitement surrounding these offerings demonstrates a growing trend where investors are seeking to hedge against inflation and economic uncertainty.

The high demand for gold can be attributed to its significant value appreciation, having increased over 40% in the last year alone and over 70% in the last five years. This escalation makes gold a compelling asset for both seasoned investors and newcomers alike. However, while gold has garnered the spotlight, platinum presents an intriguing twist in the precious metals narrative. The value of platinum has seen fluctuations, with a 15% rise in the past year but also a decline of over 8% after reaching a high of $1,100 earlier in 2024. Such volatility may make platinum less attractive to some investors, though others might see it as a strategic opportunity.

Costco’s entry into platinum bars not only expands its product portfolio but sends ripples through the precious metals market. By offering an alternative like platinum, Costco is acknowledging that consumer preferences and investment strategies are evolving. The robust sales trajectory of its gold bars speaks volumes about market conditions, and the addition of platinum may very well appeal to a segment of buyers looking to diversify their holdings. Analysts will be keen to monitor how Costco’s foray into different precious metals affects market pricing, consumer confidence, and ultimately, the wholesaler’s bottom line.

As Costco continues to expand its offerings in the realm of precious metals, it positions itself as a significant player in an increasingly competitive landscape. This move not only satisfies burgeoning consumer demand but also represents a shift in how everyday buyers approach investment in commodities. Whether investors gravitate toward the stability of gold or the potential of platinum, Costco’s strategic decisions could set a new standard for how wholesalers engage with the precious metals market. This development reflects broader changes in consumer behavior and investment patterns, marking an intriguing chapter in the ever-evolving narrative of precious metal investing.