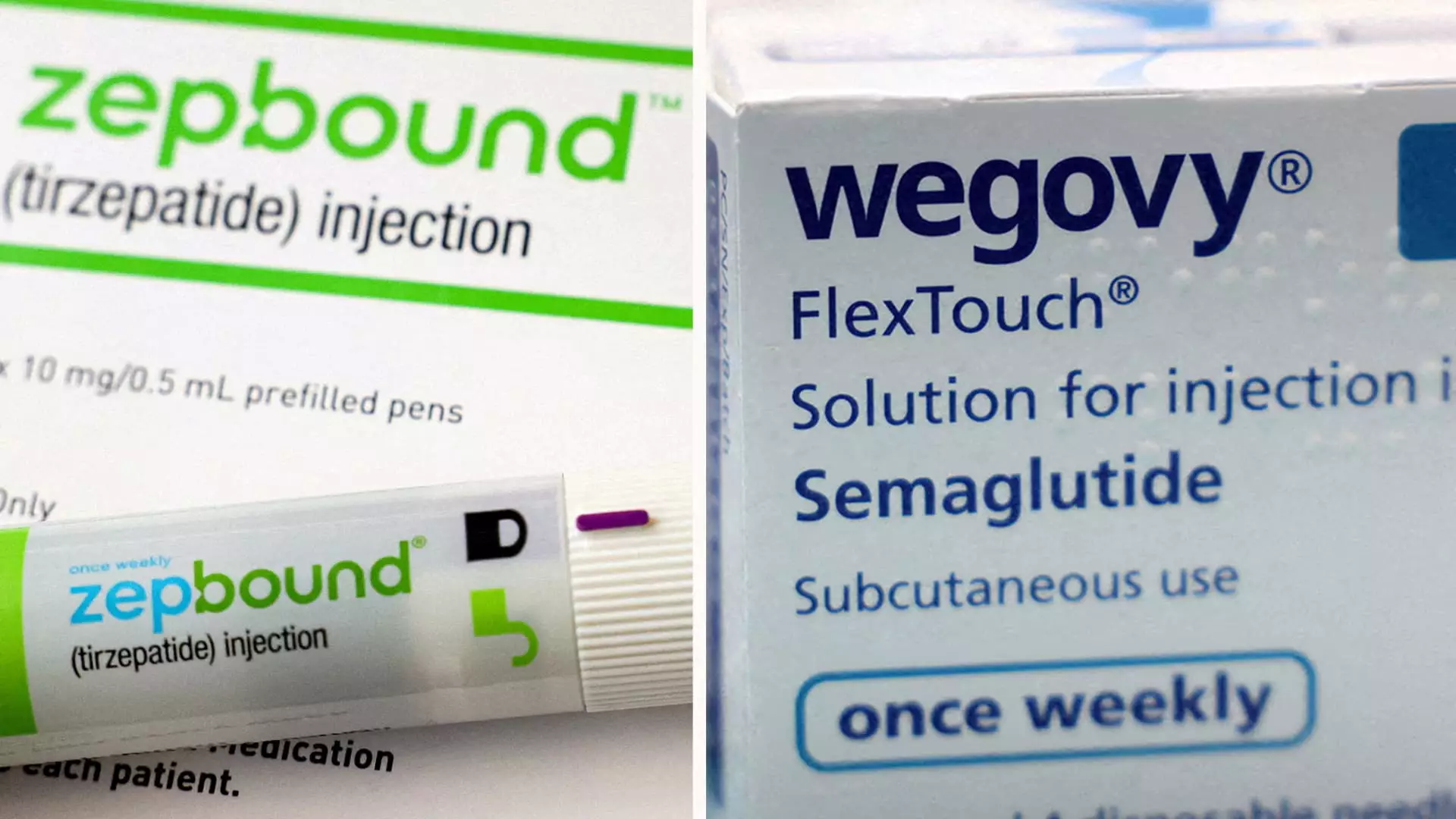

In an era where obesity rates have reached alarming heights, advancements in pharmacological treatments are met with a mixture of hope and skepticism. Eli Lilly’s recent announcement about its obesity medication, Zepbound, makes waves by suggesting that it outperforms Novo Nordisk’s established treatment, Wegovy. The results stem from the first head-to-head clinical trial of these two weight-loss solutions, which not only raises the stakes between the competing pharmaceutical giants but also presents a compelling narrative for patients seeking effective options for weight management.

Clinical Trial Insights

The crux of Eli Lilly’s claims lies in data gathered from a phase three clinical trial involving 751 patients, all of whom were categorized as obese or overweight and had at least one related medical condition—excluding diabetes. Participants received the maximum dosage of either Zepbound or Wegovy for 72 weeks. The findings unveiled that patients administered Zepbound experienced an average weight loss of 20.2%, which roughly translates to about 50 pounds. In stark contrast, those on Wegovy recorded an average weight loss of 13.7%, or approximately 33 pounds. The trial revealed that Zepbound led to a 47% higher relative weight reduction compared to Wegovy, which raises important questions about the effectiveness of these treatments for various patient profiles.

The trial data not only demonstrates Zepbound’s higher efficacy in weight loss but also highlights significant outcomes in terms of patient satisfaction and long-term results. More than 31% of Zepbound users managed to shed at least a quarter of their body weight, a strikingly higher figure in comparison to the 16% of Wegovy users achieving the same milestone. These findings pave the way for healthcare providers to reconsider strategies when prescribing weight-loss medications, potentially leading to more favorable patient outcomes.

Moreover, while earlier studies had hinted at Zepbound’s superiority, this recent trial provides robust and concrete evidence. The study’s design, which involved randomized assignments, strengthens the reliability of the results, granting healthcare professionals more confidence in recommending Zepbound as a viable option for weight loss.

The implications of these findings ripple through the obesity medication market—a sector projected to reach $150 billion annually by the early 2030s. Zepbound’s recent entry, following Wegovy’s earlier launch, positions it for rapid growth. Industry analysts have begun to speculate that Zepbound may become the best-selling drug of all time, with GlobalData estimating annual sales could reach $27.2 billion by 2030, in stark contrast to Wegovy’s projected $18.7 billion.

Such projections come at a time when the demand for weight-loss treatments has sharply outstripped supply, prompting both Eli Lilly and Novo Nordisk to ramp up production capacities. With the FDA recently announcing the availability of both drugs on its drug shortage database, patients might find improved access in the near future. Unfortunately, the reality remains that many face challenges due to inconsistent insurance coverage for weight-loss treatments, with monthly costs hovering around $1,000 for both medications.

The underlying mechanisms of Zepbound and Wegovy offer insight into their impacts on weight loss. Zepbound’s unique approach activates two gut hormones—GIP and GLP-1—to suppress appetite and regulate blood sugar levels. In contrast, Wegovy focuses solely on activating the GLP-1 hormone. Researchers suggest that this difference could be pivotal in how each drug influences the body’s metabolic processing of sugar and fat.

While both treatments have shown gastrointestinal side effects, they are generally mild to moderate. Understanding these side effects can aid patients in making informed decisions about their weight-loss journeys, especially as they weigh the potential benefits against possible adverse reactions.

Eli Lilly’s Zepbound appears to lead the charge in the ongoing battle against obesity, presenting significant advantages over Wegovy based on recent clinical trial data. This development not only offers hope to patients grappling with weight issues but also represents a critical moment in pharmaceutical competition. As the healthcare landscape continues to evolve and adapt to the growing obesity crisis, innovative treatments like Zepbound may redefine how we approach weight management strategies in the coming years. The challenge now lies in ensuring broad access to these treatments, empowering patients to take control of their health and well-being.