Nvidia has long been hailed as a titan in the graphics processing sector, consistently riding the wave of demand primarily fueled by artificial intelligence advancements. As companies flock to this emerging technology, Nvidia’s growth trajectory initially appeared limitless. However, the sentiment surrounding the company has dramatically shifted as it prepares for its next earnings report. The primary catalyst for this change? The evolving U.S.-China relationship over semiconductor exports.

This perilous reality began to manifest when the Trump administration announced stringent export licensing regulations for Nvidia’s H20 chip, specifically engineered for the Chinese market. Such restrictions are rooted in the government’s escalating fears that American-made chips could potentially enhance adversarial military capabilities. With geopolitical tensions simmering, these regulations pose a considerable burden, driving Nvidia to announce a staggering $5.5 billion write-off on its inventory—an unprecedented figure in the history of the chip industry.

The Brutal Financial Fallout

The financial implications of the export restrictions cannot be understated. Analysts now project a colossal $15 billion hit to Nvidia’s revenue over the next year due to these sanctions. While the company is still anticipating a respectable 66% revenue growth—representing $43.28 billion in March—such figures pale in comparison to the astronomical 250% growth seen a year prior. The stark deceleration spells potential turbulence for a stock that investors had come to regard as a surefire bet.

Adding to this turmoil is the uncertainty that accompanies the continually shifting regulatory landscape. With analysts suggesting that Nvidia’s expansion in the current quarter could slow to 53%, there’s an unsettling discrepancy that raises red flags over future revenue. Morgan Stanley’s assessment hints that Nvidia may have significantly underestimated the impact of the export ban, reflecting either a lack of foresight by management or growing concern over the robustness of its operational strategies.

China: A Double-Edged Sword

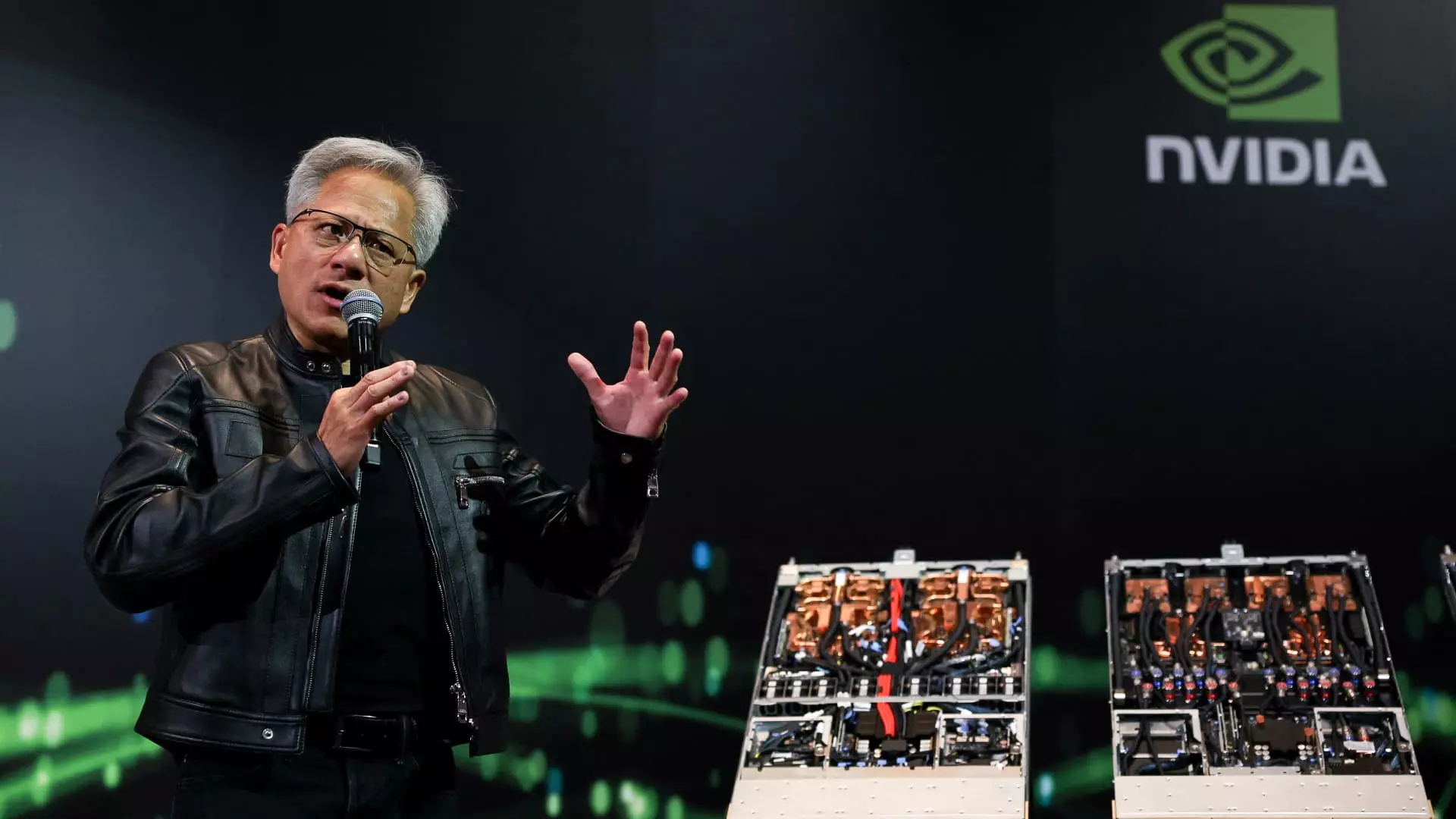

While the restrictions on exports to China present immediate headaches for Nvidia, there is an underlying narrative that should give us pause. CEO Jensen Huang recently noted that the company had seen its share of graphics processing units in China plummet from 95% to 50% following the imposition of chip restrictions. Nvidia had previously recorded an impressive $17.1 billion in annual sales to Chinese customers, including Hong Kong. With the landscape now significantly altered, one must question whether this provides an opportunity for domestic engineers within China to develop their own semiconductor technology, consequently carving out a stronger position for China in the global semiconductor market.

The damage inflicted by these sanctions may yet extend beyond Nvidia’s balance sheets, subtly undermining U.S. technological leadership. The constraints imposed on U.S. firms could inadvertently foster an environment for innovation in China. Creating a dangerous precedent, the sanctions may foment a push for engineering independence that eventually erodes the competitive advantages once held by American companies.

Conflicting Regulatory Signals

Interestingly, Nvidia recently received a sliver of reprieve as the Biden administration reconsidered some export regulations, specifically the “AI diffusion rule,” which would have further emboldened constraints on technology exports. However, the commitment to regulating Nvidia’s exports remains intact, with hints of a forthcoming replacement rule that might exacerbate uncertainty surrounding approvals for new chips like the H20.

This could put Nvidia in a precarious position where lobbying becomes a full-time job. The statement from Morgan Stanley analysts suggests that the nuances of future chip regulations aren’t likely to be addressed during upcoming earnings calls. It raises a pressing question: how can Nvidia develop a coherent long-term business strategy under such diffuse regulatory clouds?

The Road Ahead for a Giant

As Nvidia prepares for its upcoming earnings report, it stands at a crossroads. With impressive revenue growth and market dominance overshadowed by regulatory restrictions and geopolitical tensions, the company finds itself grappling with challenges it has rarely faced before. The rapid development of competitive capabilities within China, coupled with fluctuating regulatory stances from the U.S., suggests that the road ahead could be fraught with obstacles. What will define Nvidia’s future may no longer be just its technological prowess but its ability to navigate these treacherous political waters. Future investors should brace themselves; the stakes in the semiconductor game have never been higher.