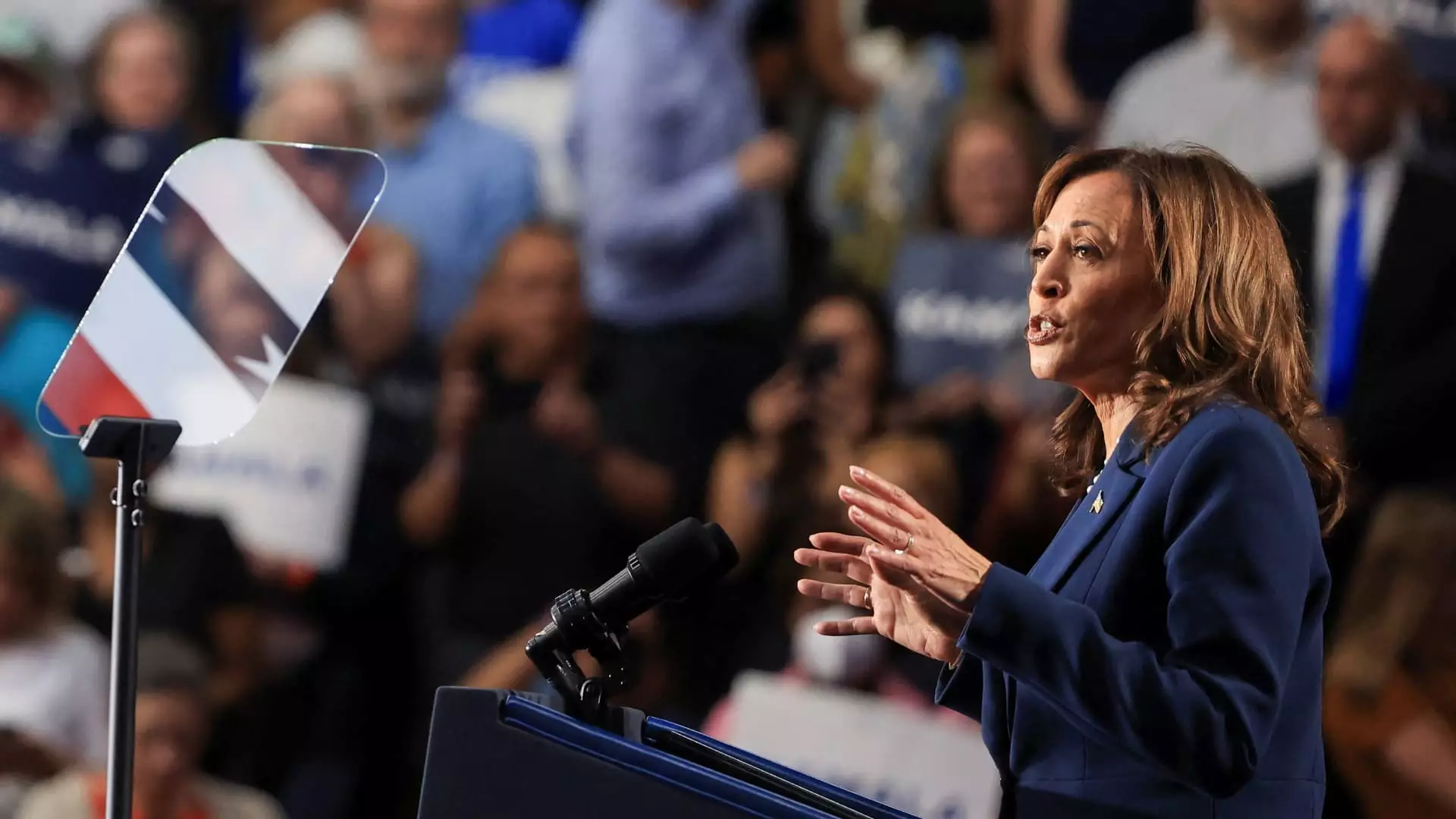

In her recent address in West Allis, Wisconsin, Vice President Kamala Harris outlined a critical element of her presidential aspirations: fortifying the middle class. As she ascends as the frontrunner to succeed President Joe Biden as the Democratic candidate, her commitment to addressing economic disparity stands at the forefront. Harris’s assertion, “When our middle class is strong, America is strong,” encapsulates a philosophy she has championed throughout her political career. This focus on the middle class is not merely a campaign slogan; it reflects a broader recognition of the crucial role that economic equity plays in ensuring national prosperity.

Harris’s campaign emphasizes the wealth gap as a significant issue that needs urgent attention. The implications of this focus extend beyond political rhetoric; they point toward a comprehensive strategy aimed at boosting lower- and middle-income families. The working class has faced myriad challenges over the past few years, and Harris’s policies appear aimed at reinstating their financial stability as a vital national interest.

One of Harris’s hallmark initiatives, known as the LIFT (Livable Incomes for Families Today) Act, proposes a considerable annual tax credit of up to $3,000 for individuals and $6,000 for couples within lower- and middle-income brackets. Contrary to the administration’s general progressive agenda, this tax relief is designed explicitly to provide immediate financial relief rather than entrench economic inequalities further.

Prominent economists have hailed this proposal as a beacon of hope for renters who find themselves grappling with rising living expenses. With the escalating cost of living, the LIFT Act seeks to address the pressing financial burden placed on working-class families. Francesco D’Acunto, an associate professor of finance at Georgetown University, emphasizes that direct financial assistance can mitigate some of the economic pressures these households face, contrasting sharply with more indirect measures like rent caps.

The chilling acknowledgment is that the approach favored by some policymakers—such as a 5% rent cap—could inadvertently lead to increased inefficiencies and market distortions. Professors Karl Widerquist and Jacob Channel underscore that regulatory measures may push landlords toward removing their properties from the rental market altogether. In light of this, the LIFT Act represents a targeted, no-nonsense approach to bolster economic stability for renters directly.

The current economic climate presents numerous obstacles that make Harris’s proposals both timely and vital. Rising inflation has severely impacted real incomes, particularly for working-class families, leading to widespread economic anxiety. As Tomas Philipson, former chair of the White House Council of Economic Advisers, pointed out, this stagnation in wages creates a precarious situation where many families feel suffocated by their financial realities.

Additionally, the evolving landscape of artificial intelligence in the workforce fuels fears of job displacement, making the need for robust social safety nets more pressing than ever. Laura Veldkamp, a finance and economics professor at Columbia University Business School, highlights the existential dread surrounding economic security and job stability faced by countless workers. A renewal of tax credits like the LIFT act can function as a kind of insurance policy against these structural changes.

However, the financial burden of such an expansive initiative raises eyebrows. Previous estimates from the Tax Policy Center indicated that funding the LIFT Act may impose significant strains on the federal budget. Harris’s prior suggestion to repeal certain provisions of the Tax Cuts and Jobs Act for higher-income earners serves as an indication of her willingness to pursue tough fiscal decisions to fund necessary support for the middle class.

As the landscape shifts toward an increased emphasis on the Child Tax Credit, policymakers face tough choices about funding and priorities. The pandemic’s downturn highlighted the need for additional support for families, which was achieved through the expanded Child Tax Credit. This measure successfully reduced child poverty to its historical low during 2021, showcasing the effectiveness of direct financial assistance.

Despite the tangible benefits of the Child Tax Credit, its future remains uncertain amid complex congressional negotiations. There is a palpable urgency among Democrats to utilize tax policy as a pivotal tool for lifting families from the struggle against poverty. However, whether Harris’s administration will revive her focus on the LIFT Act or prioritize an expansion of the Child Tax Credit remains a point of contention.

Ultimately, as Kamala Harris forges ahead in her campaign, the economic framework she advocates for America will reveal the party’s commitment to addressing deep-seated inequalities. The American electorate is yearning for solutions that resonate beyond mere promises, bringing real relief to those who have felt marginalized in an economy that continues to evolve at breakneck speed. This coming discourse could determine not just the direction of the Democratic party, but the future of the nation’s middle-class recovery.