In a surprisingly cautious atmosphere, AMD’s latest earnings report has provoked a dramatic market response, with shares plunging over 5%. This swift decline reveals the underlying fragility of investor confidence, which is increasingly tethered not just to company fundamentals but also to geopolitical headwinds. The earnings, which fell marginally short of analyst expectations, expose a tension between AMD’s bullish outlook and the persistent limitations imposed by external political forces. This scenario underscores a troubling trend: tech giants are no longer insulated from international regulatory entanglements that threaten their growth trajectories. Investors, having been lulled into a false sense of security by impressive growth numbers—including a 32% year-over-year revenue increase—are now confronting the reality that AMD’s recent optimism may be overly ambitious and unsustainable in the current climate.

Regulatory Risks: A Heavy Cloud Over Innovation

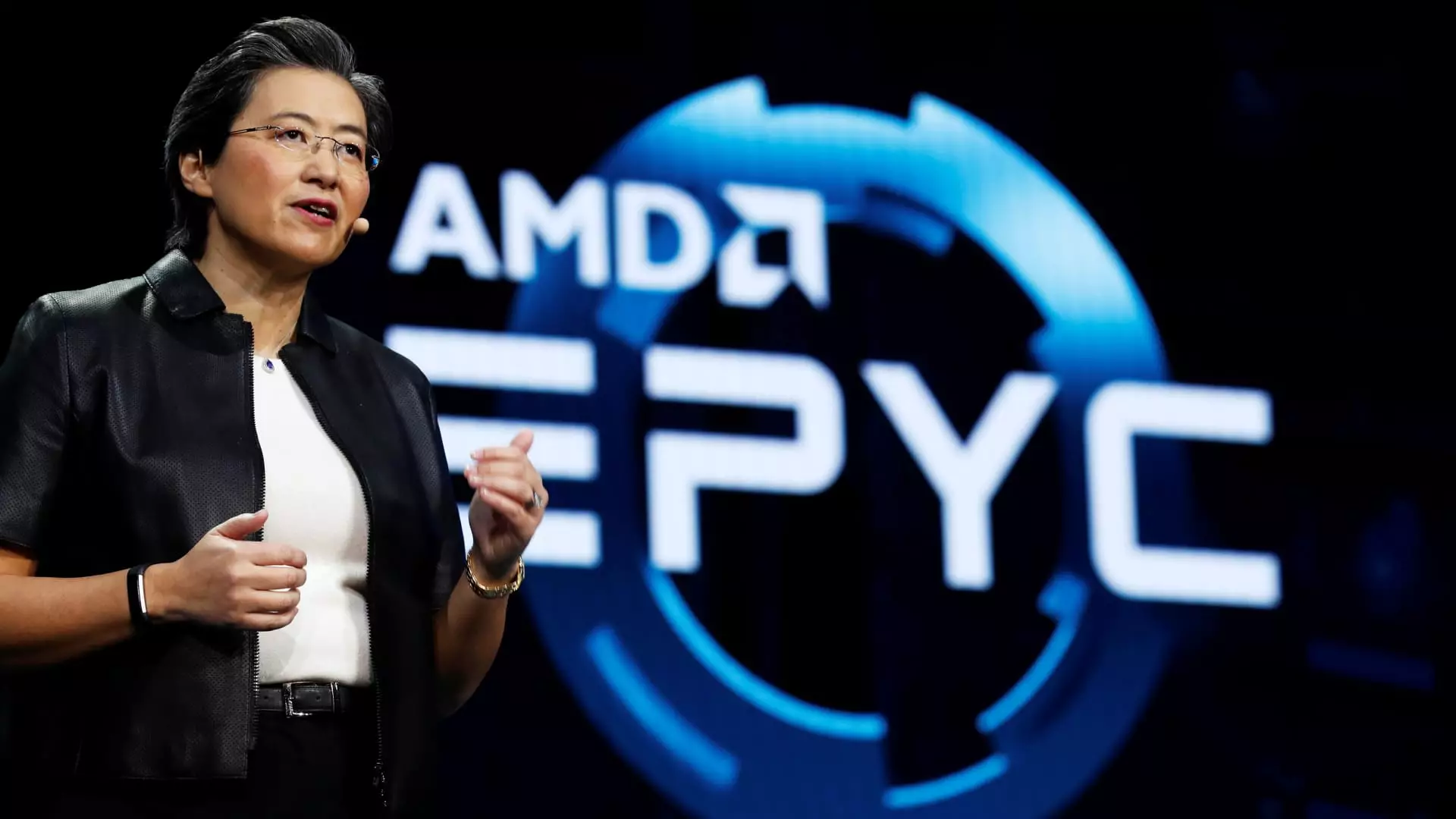

CEO Lisa Su’s candid acknowledgment of U.S. export restrictions on AI chips highlights a critical vulnerability that could hamper AMD’s strategic ambitions. While the company continues to project confidence in its portfolio, the reality is fraught with uncertainty: its ability to recapture China shipments remains uncertain at best. The company’s plan to navigate these restrictions appears more like a high-wire act than a clear pathway to growth. The fact that AMD is working closely with the U.S. government indicates a recognition of how political decisions can quickly derail technological ambitions. The restrictions on the MI308 AI chip, designed specifically for the Chinese market, serve as a stark reminder that global supply chains are now heavily politicized. This interference not only delays revenue realization but also risks alienating markets integral to AMD’s long-term growth — markets where demand remains robust but access is now uncertain.

Overhyped Optimism: The Mirage of Future Prosperity

Despite AMD’s confident projections and Su’s assertions that the data center segment remains the “main driver of growth,” skepticism is warranted. While a 14% increase in the data center segment can be touted as a sign of strength, it should not obscure the potential for operational risks and escalating expenses that threaten to erode margins. The company’s emphasis on “inflection points” and “opportunities” rings hollow if such prospects remain predicated on assumptions that are increasingly fragile. The recent guidance for an $8.7 billion revenue in the current quarter, while seemingly optimistic given the market’s outlook, appears to gloss over the substantial headwinds posed by regulatory delays and geopolitical tensions. Market participants are right to question whether this projected growth is sustainable or merely aspirational—especially when elements beyond AMD’s control shadow its future prospects.

The Illusion of Autonomous Growth: Datacenter Hype and Industry Reality

While AMD attempts to cast its datacenter business as the engine of future expansion, analysts continue to voice doubts about the actual scalability of this segment. The claim that productivity improvements may be hampered by mounting operating expenses calls into question whether AMD can truly leverage its position in the high-stakes data center arena. Competitors with more aggressive cost management strategies and diversified geopolitical accommodations could outpace AMD if it remains overly dependent on a narrow segment of large clients. Moreover, AMD’s lofty assumptions about inflection points and future customer demands seem disconnected from the broader industrial and economic realities; a sector heavily influenced by macroeconomic cycles and geopolitical stability, both of which are currently in a state of flux.

Chasing the Illusive Market Magic

Ultimately, AMD’s narrative reflects a broader industry obsession with possible golden ages—where breakthroughs in AI and cloud computing will catalyze endless growth. Yet, the company’s recent struggles expose a more sobering truth: technological innovation alone cannot shield a firm from the disruptive forces of politics, regulation, and global economic shifts. The company’s efforts to work with the U.S. government and shift to new product generations are necessary but insufficient. Without addressing the geopolitical realities and reorienting strategies to be resilient against inevitable setbacks, AMD risks overpromising on a future that might never materialize at the scale envisioned. The current market correction may serve as a critical reality check, forcing a reassessment of how much faith can be placed in AMD’s strategic projections and growth hallucinations.