In recent weeks, Equinix’s stock has plummeted nearly 18%, triggering alarm bells among short-term investors and market skeptics. The initial reaction is often one of panic—viewing rising capital expenditures (capex) and lowered adjusted funds from operations (AFFO) forecasts as warning signs of impending decline. But this knee-jerk reaction reveals a critical misjudgment rooted in short-termism. Investors fixated on immediate numbers fail to grasp the strategic underpinnings of Equinix’s ambitious expansion plans, which are designed to ensure its dominance in an increasingly data-driven world.

The surge in capex, projected to reach up to $5 billion annually from 2026 onward, appears daunting at first glance. However, when viewed through a long-term lens, these investments are not reckless overspending; they are calculated bets on future demand fueled by artificial intelligence, cloud growth, and hyperscaler expansion. The market’s tendency to interpret high capex as a cash drain demonstrates a troubling myopia that undermines the potential for sustainable growth. Equinix’s reluctance to communicate its vision more clearly only exacerbates this misunderstanding, causing current investors to undervalue the real strategic value of these investments.

This situation underscores a broader problem in the financial community: an overreliance on short-term metrics that distort the true trajectory of high-capital businesses. As equity markets become more volatile, the risk is that the focus on immediate returns discourages companies from making necessary, innovative investments. Equinix’s situation exemplifies how the market’s fixation on near-term AFFO margins neglects the foundational importance of positioning the company for future leadership in data infrastructure.

Global Interconnection as a Resilient Business Model

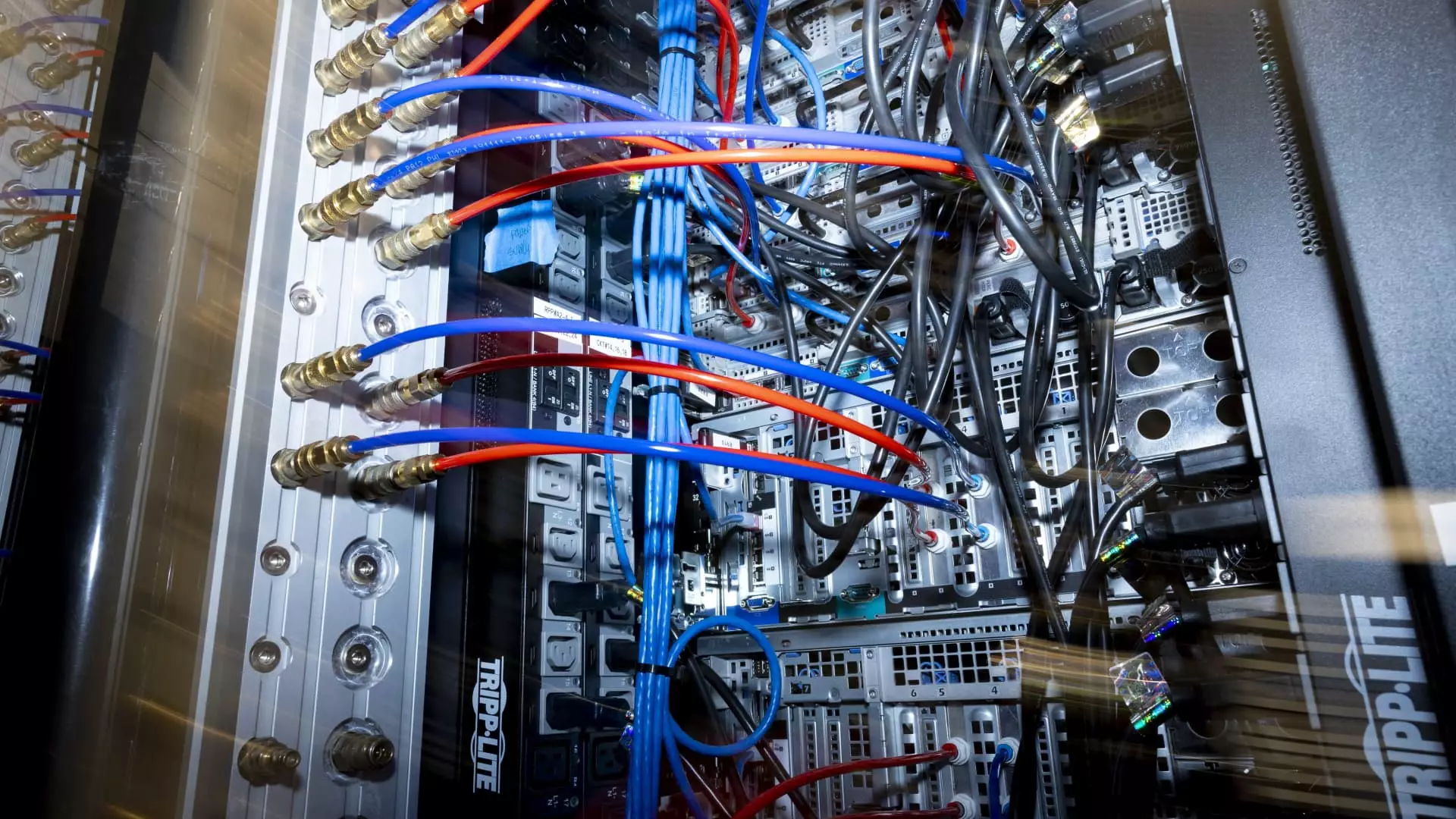

Equinix’s strategic advantage lies not just in the physical footprint of its 270 data centers but in its core function as an ecosystem enabler—interconnecting networks, cloud providers, and enterprises across the world. This interconnectedness creates a sticky, high-value offering that is less susceptible to the booms and busts of the broader economy. It positions the company as a central hub in the digital economy, a role that future-proof growth investments can amplify rather than threaten.

The company’s focus on key markets—Americas, Asia-Pacific, EMEA—ensures it remains close to the end-user demand centers that are fueling global digital transformation. As AI matures and demands more inferencing capabilities, Equinix’s global platform becomes ever more vital—a backbone facilitating low-latency, secure, and scalable AI deployment. This implicit shift towards AI inference, rather than training, is crucial; it offers higher margin opportunities and less resource intensity, areas in which Equinix can position itself as an indispensable player.

Yet, the market undervalues this scenario because of its short-term focus. The real story is about a company making calculated investments to secure its leadership in a future where data centers are not just warehouses of hardware but active participants in the AI revolution. Equinix’s ability to leverage its interconnection services for AI inferencing could reshape its revenue model and margins over the next decade, turning current fears into future profits.

The Power of Strategic Activism and Industry Expertise

Enter Elliott Management: a firm renowned for its activist approach, but also for its deep industry knowledge, especially in data centers. Unlike passive investors or short-term speculators, Elliott’s strategy involves actively guiding companies toward sustainable long-term value creation. Its familiarity with data center operations—evident from its past involvement with Switch and Ark Data Centers—gives it a rare perspective that many market participants lack.

Elliott’s increasing stake in Equinix signals a belief that the company’s current mispricing provides an opportunity for strategic intervention. The firm’s operational and governance expertise could be instrumental in calibrating Equinix’s expansion and communication strategy. For instance, Elliott might advocate for better articulation of the company’s long-term vision, highlighting how the current capex investments will yield high returns and how the AI opportunity is far more significant than the market recognizes.

Additionally, Elliott’s knowledge could help streamline Equinix’s operational efficiencies, reduce financing costs through financial engineering, and elevate margins beyond current targets. By pushing for improved transparency and more aggressive communication, Elliott can help the company realign investor expectations with the realities of a rapidly evolving digital infrastructure landscape.

The recent dip in Equinix’s stock, while painful in the short term, presents a rare window for long-term investors to acquire a premier digital infrastructure asset at a discounted valuation. The company’s strategic investments, supported by industry insiders like Elliott, are preparing it to capitalize on AI and cloud-driven demand in ways short-term-focused investors may not immediately see. As the world becomes ever more interconnected, Equinix’s foundational role will only strengthen—if managed with patience and strategic clarity.