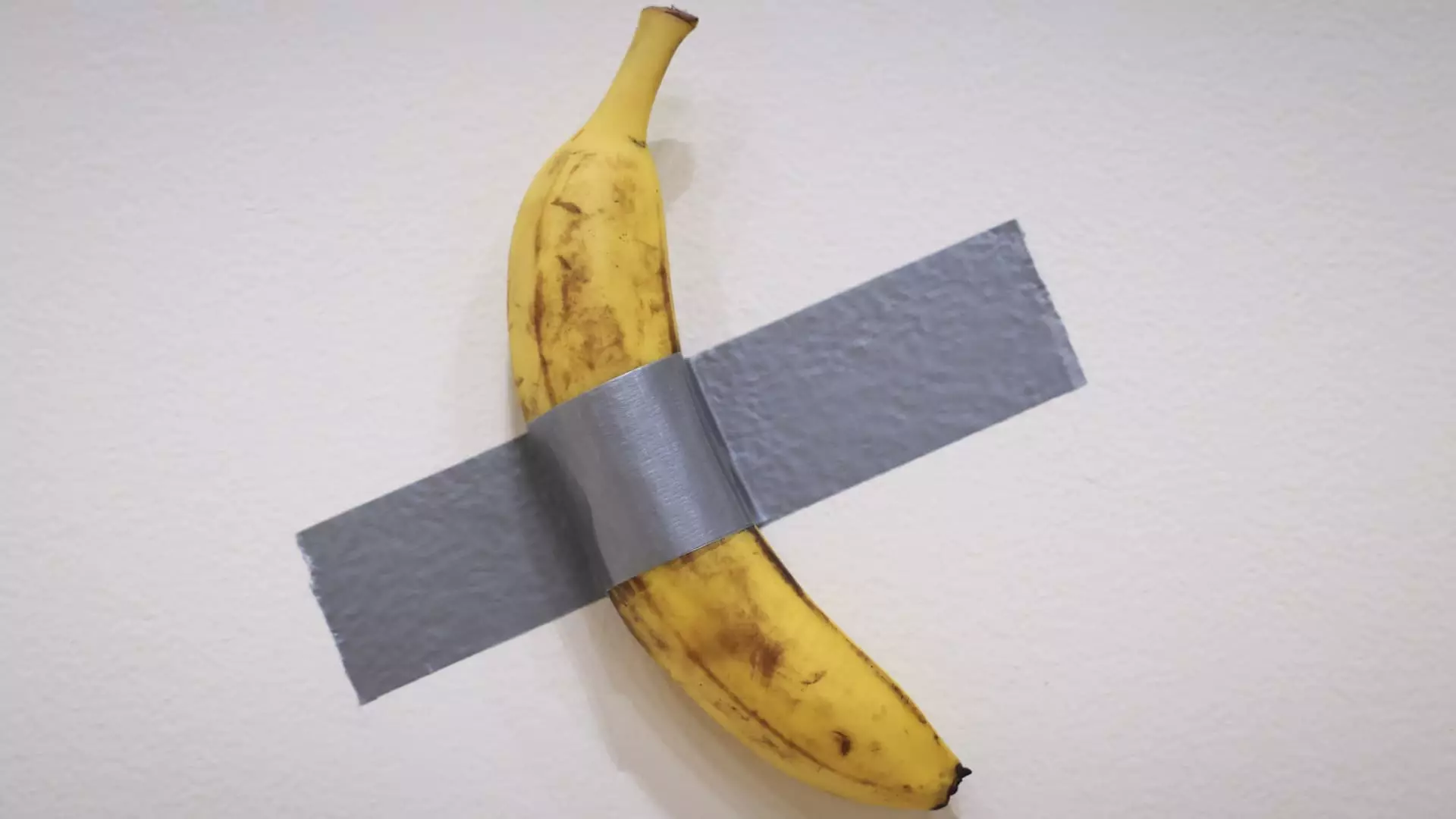

In a remarkable blend of contemporary art, cryptocurrency, and social media culture, the sale of Maurizio Cattelan’s infamous artwork, “Comedian,” has drawn both intrigue and skepticism. This article dissects the implications of Justin Sun’s recent $6.2 million purchase of a banana duct-taped to a wall, shedding light on the evolving landscape of art valuation, consumer behavior, and cultural critique.

The high-stakes world of art investment has witnessed a significant shift in recent years. The traditional barriers defining valuable art have blurred, allowing for the rise of unconventional pieces that challenge societal norms. Justin Sun’s purchase exemplifies this trend. By acquiring a banana attached with a simple roll of duct tape, Sun is essentially betting on the cultural heft that this piece carries—its viral nature far more valuable than the banana itself.

The art market’s evolution is underscored by the willingness of investors to pay astronomical sums for objects with ephemeral qualities. Cattelan’s “Comedian,” which debuted at Art Basel Miami Beach in 2019 with a relatively modest price tag of $120,000, quickly escalated to a cultural phenomenon. The art-world frenzy surrounding the piece was not solely about aesthetics; it became a talking point that encapsulated themes of modernity and societal absurdity.

Sun’s decision to make his purchase using cryptocurrency is significant, particularly as it highlights the growing acceptance of digital currencies in traditional avenues. Sotheby’s, a long-standing institution in the auction world, accepting cryptocurrency as payment for a work of art denotes a seismic shift in how art is bought and sold. This transaction reflects a broader trend, where the intersection of digital finance and tangible assets blurs the lines for collectors and investors.

Unlike typical artworks that derive value from craftsmanship or historical significance, the essence of “Comedian” derives from ownership, represented through a certificate of authenticity. In this sense, the banana serves more as a conceptual piece akin to NFTs—art that exists in the digital realm where scarcity, ownership, and provenance matter more than the item itself.

Viral Art’s Cultural Commentary

The narrative surrounding “Comedian” extends beyond art investment; it also invites critical reflection on contemporary culture. Cattelan’s piece acts as a commentary on consumerism and the absurdity of fame in the digital age. It capitalizes on social media’s ability to disseminate content rapidly, elevating the mundane—such as a banana—into the realm of critical discourse.

Sun himself noted that owning “Comedian” symbolizes a cultural juncture connecting the art world with memes, social commentary, and the cryptocurrency community. His intentions to consume the banana as part of the artistic experience further illustrate this interplay between high culture and pop culture, suggesting that art can be both satirical and participatory.

The Future of the Art Market

The $6.2 million auction result resonates with changing dynamics in the art market, where traditional valuations are increasingly influenced by external market conditions, including fluctuations in the stock market and evolving collector confidence. The resurgence in sales at Sotheby’s, combined with record-breaking auctions this week, indicates an art market poised for recovery following recent downturns.

Sun’s purchase signifies more than an extravagant investment; it is a reflection of a cultural shift wherein art is perceived as a vehicle for dialogue and interaction. As more collectors seek pieces that resonate with contemporary discourse, the boundaries of what constitutes valuable art will continue to expand, merging the worlds of technology, social commentary, and traditional aesthetics.

The saga surrounding Justin Sun’s acquisition of Cattelan’s “Comedian” reflects a confluence of cultural forces that are redefining art as we know it. The intersection of cryptocurrency, viral phenomena, and challenging artistic expressions invites us to reconsider the future of art investment—a landscape where the surreal can be both a serious commodity and a playful critique of our times.