As the American economy grapples with inflationary pressures and rising living costs, a concerning trend has emerged: the massive increase in credit card debt. In 2024, credit card balances soared to an unprecedented $1.17 trillion, underscoring a significant shift in consumer behavior. This phenomenon encompasses not only the typical consumer but extends even to individuals in affluent financial straits, raising questions about debt management and spending habits across the socio-economic spectrum.

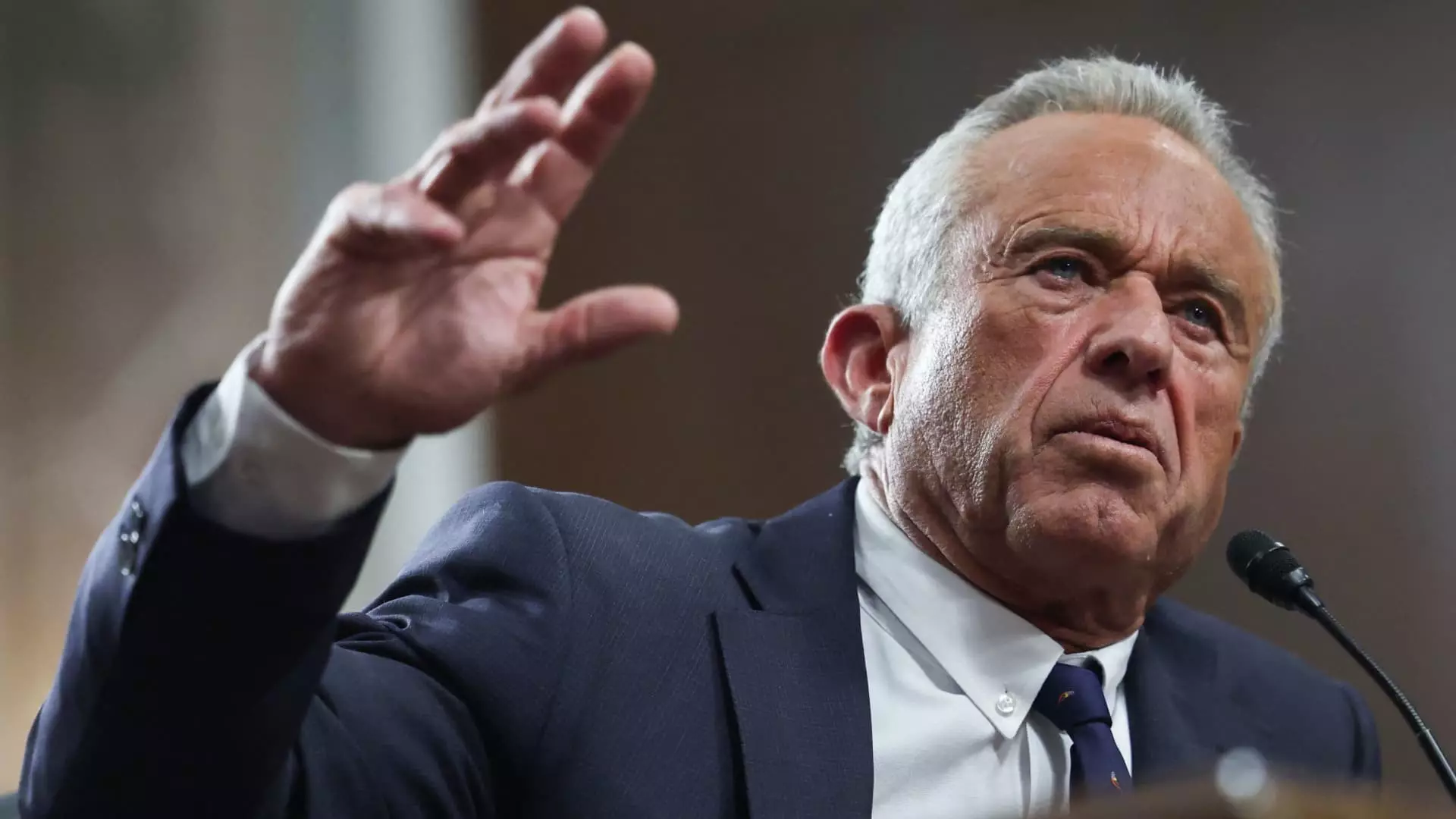

A salient case exemplifying this trend is that of Robert F. Kennedy, Jr., a high-profile figure with considerable wealth, who acknowledged a staggering credit card debt ranging from $610,000 to $1.2 million. His disclosures reveal interest rates that hover between 23.24% and 23.49%. This revelation has invited scrutiny from financial experts who are baffled by the accumulation of such high debt for someone with an estimated net worth of $30 million. Ted Rossman, a senior analyst at Bankrate, characterized Kennedy’s debt as “truly massive,” prompting serious reflection on the financial habits of even the wealthiest consumers.

The Broader Implications of Increasing Debt

Kennedy’s situation opens a broader discourse about credit card usage as a safety net amid economic uncertainty. Leading financial analysts like Matt Schulz emphasize that many Americans are perceiving their credit cards as alternative emergency funds, particularly as inflation strips away financial leeway. With living costs steadily climbing, many individuals find themselves trapped in a cycle of credit dependency, utilizing plastic to cover expenditures that once could have been managed with disposable income.

The data corroborate this narrative: as of the third quarter of 2024, the average American credit card holder bears a debt of about $6,380. Given the average interest rate of credit cards sitting around 20.13%, the implications of carrying such balances can be financially devastating. Interest can accumulate rapidly, significantly inflating the total amount owed over time.

Experts assert that individuals in all income brackets should prioritize debt repayment, particularly in the current climate of high interest rates. Engaging in a structured payment approach can yield significant returns—effectively providing a guaranteed, risk-free return equivalent to the interest rate charged on the debt. For a person like Kennedy, making substantial payments toward reducing his credit card debt may appear feasible, yet the longer the balances remain unpaid, the higher the eventual costs climb. If he were to pay only $50,000 a month towards his lower balance, for instance, he would still incur nearly $93,000 in interest over 15 months.

Financial planners argue that maintaining good financial health requires mindful management of credit. Carolyn McClanahan presents a compelling perspective: with considerable income, accruing such debt lacks justification, especially when robust repayment strategies could alleviate the financial burden. This principle should resonate with all consumers, highlighting the importance of living within one’s means and making informed financial decisions.

Diving deeper into the profiles of borrowers, it is evident that high-income individuals may face unique challenges regarding credit card debt. Bankrate’s findings indicate that 59% of earners over $100,000 have been in debt for over a year, with younger consumers skewing towards a more protracted reliance on credit. Higher credit limits can often be both a blessing and a curse, leading to overspending and long-term debt.

Interestingly, luxury credit cards, such as the American Express Centurion Card, come with their own set of costs and features, affecting spending habits among wealthy borrowers. The enticing rewards—exclusive airport lounges, elite hotel status, and more—often entice affluent individuals into behaviors that could contradict sound financial principles. Charlie Douglas brings attention to a more prudent alternative: utilizing established lines of credit for significant expenses rather than engaging the punitive interest structure of credit cards.

As credit card debt continues to surge among both low-income and high-income demographics, it has become vital for consumers to reassess their spending habits and financial strategies. The stark reality is that in an environment where inflation remains tenacious and economic stress is palpable, prudent debt management cannot be understated.

While the wealthy may have the resources to absorb higher debt levels, the practices they adopt often reconcile risk and reward in intricate ways needing closer examination. The collective experience serves as a pivotal lesson on the importance of financial literacy and disciplined spending—essentials for navigating today’s complex and challenging financial landscape.