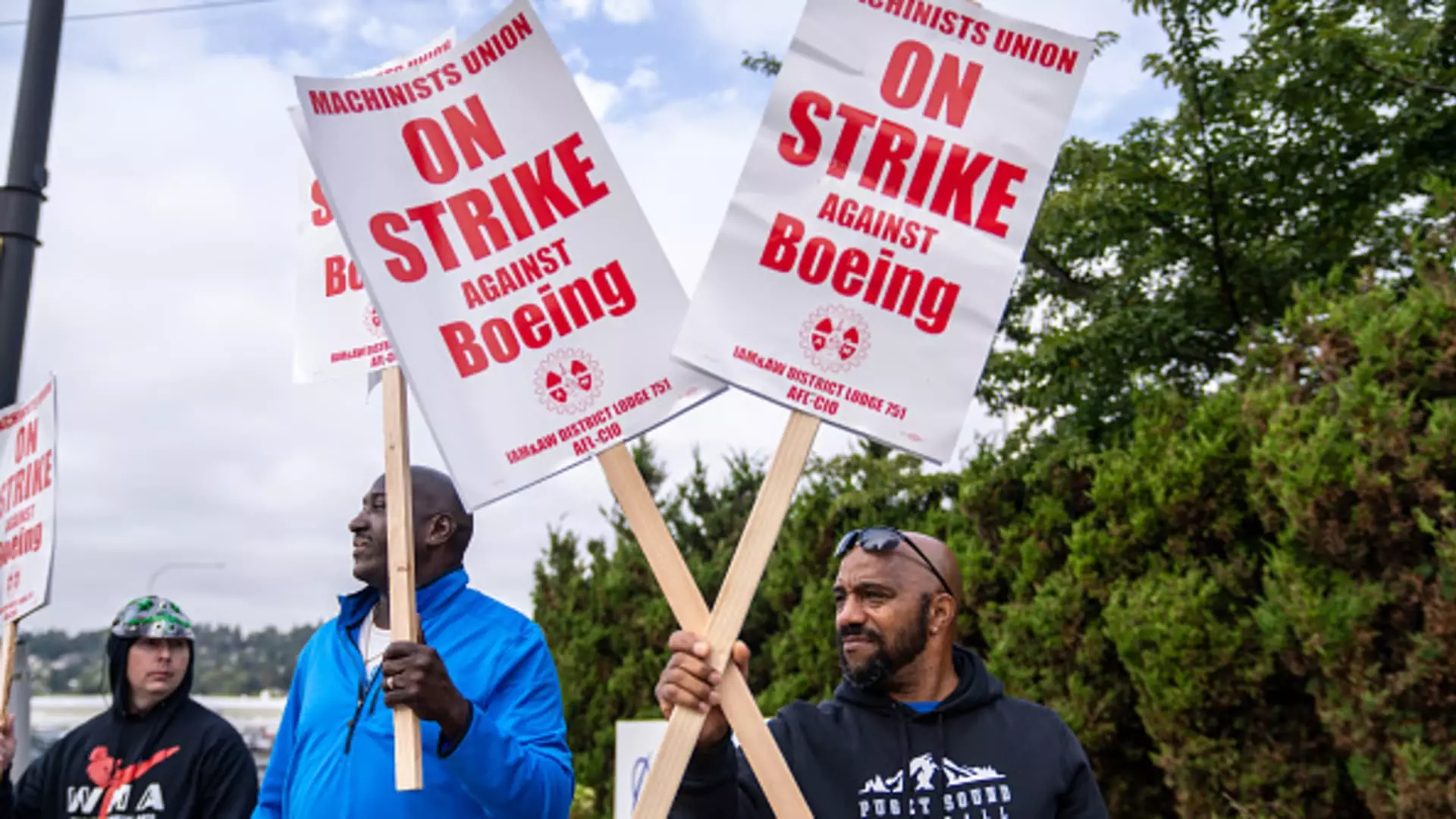

The aerospace industry has recently been shaken to its core with Boeing facing unprecedented challenges. At the forefront of these challenges is an ongoing strike involving over 30,000 machinists who walked away from their jobs after rejecting a tentative contract deal. As tensions rise and costs spiral, Boeing finds itself under immense pressure, particularly for its new CEO, Kelly Ortberg, who was appointed to lead the company through turbulent times marked by crises that have plagued it for several years.

The Impact of the Strike

The ramifications of the machinists’ strike are rapidly unfolding. According to estimates by S&P Global Ratings, the strike could cost Boeing upwards of $1 billion each month. This is more than just a labor dispute; it encapsulates the culmination of ongoing production issues and financial losses that have become synonymous with Boeing’s recent history. The situation is exacerbated by a significant backlog of aircraft orders and ongoing production challenges, including previous quality control issues that arose in their 737 Max line—a model already marred by two fatal crashes and subsequent investigations.

With airplane production temporarily halted in Seattle and other locations, Boeing’s cash flow is severely impacted, pushing the company further into a financial quagmire. The company’s recent attempt to present a sweeter contract proposition to the union was quickly dismissed as unnegotiated, demonstrating a disconnect between Boeing’s administrative strategies and the workforce’s demands.

The negotiation process has proven to be a complex minefield, especially when recent federally mediated discussions have hit a brick wall. This breakdown has added weight to Boeing’s allegations against the union for bad faith negotiations. Jon Holden, the president of the International Association of Machinists and Aerospace Workers union (IAM), has urged for renewed negotiations, emphasizing that any contract acceptance will ultimately lie with the union’s members. While pressure mounts for Boeing to improve its offerings, the likelihood of fully restoring former pension plans remains low.

What complicates matters further is the fact that union members are now without paychecks and health insurance benefits—a significant shift that hasn’t been felt since the last strike in 2008. In response to this financial strain, workers now have access to alternative job opportunities, such as food delivery and warehouse roles. Despite the grim picture, this approach implies a more resilient workforce willing to pivot to mitigate the impact of lost wages.

As Ortberg steps up to the pressure of leading Boeing, he has announced intentions to lay off about 10% of the global workforce, alongside halting production of certain aircraft models while extending delivery timelines for new ones. His statements highlight an acute awareness of the need for substantial restructuring amid dwindling revenues, which are expected to result in losses close to $10 per share for the third quarter.

The financial results illustrate an ongoing trend of significant losses that the company has encountered since 2018, raising concerns among investors and analysts alike. Richard Aboulafia, a noted aerospace expert, has criticized Boeing’s strategy, suggesting that the company is inadvertently dismantling the very teams capable of stabilizing production and profitability. Labor constitutes a marginal 5% of the cost of final assembly for aircraft; however, losing a skilled workforce may lead to larger operational inefficiencies.

Looking ahead, the potential for Boeing to rebound is fraught with uncertainties. Analysts have warned that if the strike continues coupled with production halts, Boeing may face a risk of being downgraded to junk status. This may lead to drastic funding measures, potentially requiring a $15 billion equity raise. For a company attempting to stabilize its operations, the implications of such a downgrade could be devastating.

Ortberg is balancing the need for efficiency alongside the imperative of innovation at Boeing, which has been hampered by its assortment of past mistakes and criticism regarding quality control. As he prepares for his first earnings call as CEO, addressing stakeholders will be crucial in restoring confidence in the company’s trajectory.

Boeing is navigating a tumultuous period marked by a crucial labor strike, dwindling financial setbacks, and a pressing need for structural change. The path ahead is uncertain, but the stakes are undeniably high for one of America’s most iconic manufacturers. Only time will tell if Ortberg’s leadership will steer Boeing back on course or further entrench it within a cycle of crisis and labor disputes.