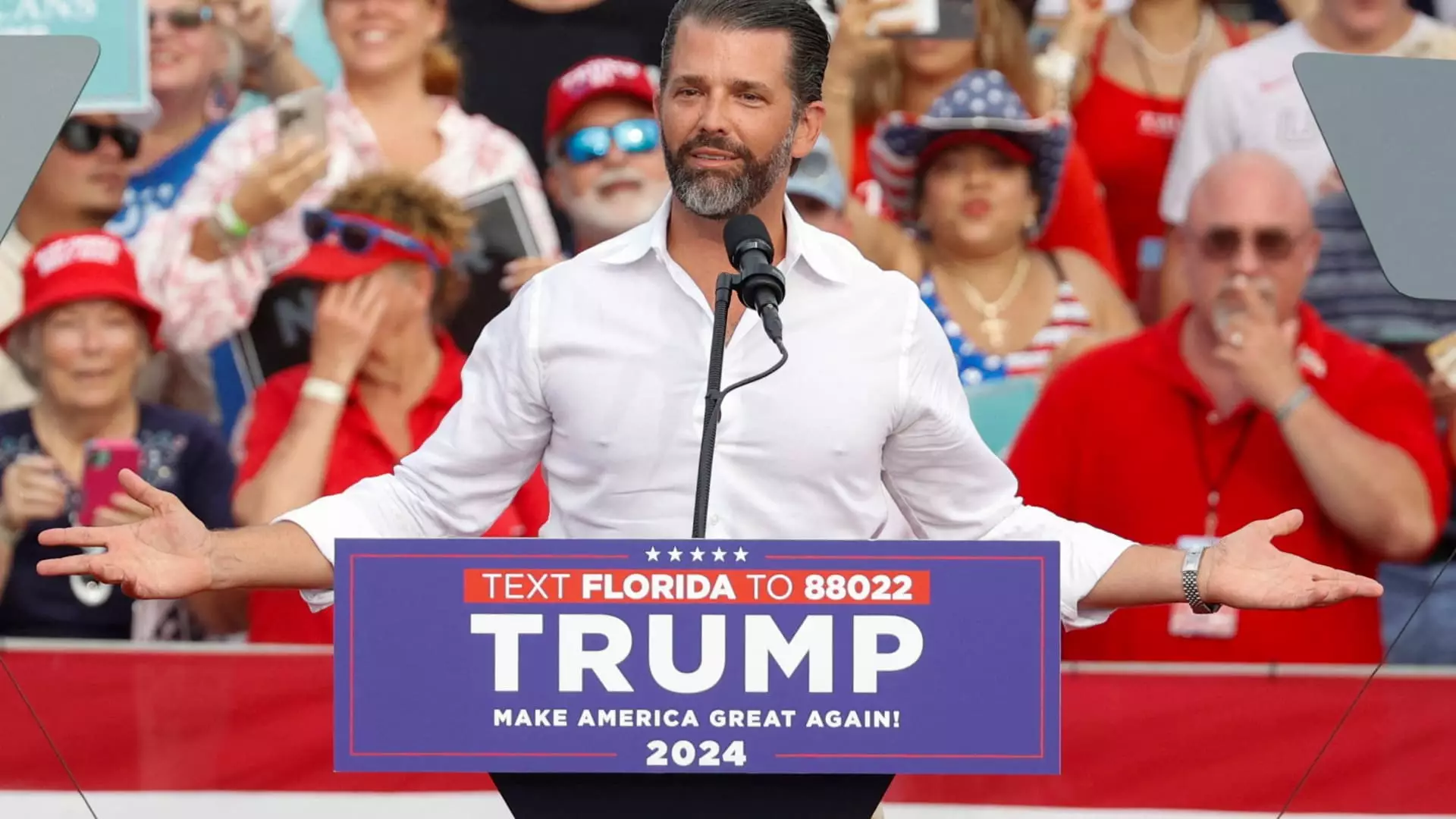

In the ever-evolving landscape of the stock market, few events can send shares soaring quite like a high-profile announcement. Recent news of Donald Trump Jr. joining the board of PSQ Holdings has set the stock market abuzz, sparking a remarkable surge in the value of the company’s shares. As the owner of the online marketplace PublicSquare, PSQ saw its stock price catapult by an astonishing 185% during trading hours after this announcement broke. PublicSquare, a platform emphasizing core values of “life, family, and liberty,” has positioned itself strategically in the marketplace catering to a specific consumer demographic.

The endorsement of a prominent figure like Donald Trump Jr. is not merely a matter of political association; it signifies a broader strategy for PSQ. The company’s CEO, Michael Seifert, highlighted Trump Jr.’s previous investment in PublicSquare prior to its IPO, underlining his long-term commitment. This familiarity with the company is pivotal as it suggests a shared vision that aligns with the organization’s mission and objectives. Trump Jr.’s considerable experience in business, particularly within industries that resonate with conservative values, positions him as an asset at the board level. His involvement could bring a form of legitimacy to the company, fostering trust among conservative consumers who seek alternatives to mainstream corporations.

Despite the wave of optimism following the appointment, it’s crucial to examine PublicSquare’s financial landscape with a discerning eye. In the most recent quarter, the company reported net revenues of $6.5 million, paired with operational losses exceeding $14 million. The stark contrast of high revenue figures against substantial losses points to a business still in its developmental phase. While the stock surge may reflect investor excitement and confidence in future growth, the underlying financial realities suggest that PSQ still faces significant challenges to achieve sustainability and profitability.

Trump Jr. is not new to the business world, having recently engaged with other companies, including joining venture capital firm 1789 Capital and the board of Unusual Machines, a drone manufacturer. His strategic moves indicate a deliberate effort to align himself with companies that aim to cater to conservative markets, potentially enhancing his personal brand. The significant increase in PSQ’s shares, along with the performance of Unusual Machines on similar announcements, reveals an intriguing trend: the intertwining of political influence and market dynamics.

As we look ahead, the future of PSQ Holdings remains a topic of interest. The company must navigate its operational challenges while capitalizing on the momentum generated by Trump’s son joining the board. The need to convert hype into tangible financial performance will be vital. The marketplace for conservative products may present growth opportunities, but only if PublicSquare can effectively leverage its unique positioning and the expertise of its board members in a competitive environment. Investors and market watchers should remain cautiously optimistic, acknowledging the potential for growth while keeping an eye on the company’s financial health and operational efficiency.

The intersection of celebrity influence, corporate strategy, and consumer values will continue to shape the trajectory of PSQ Holdings. Whether the company can convert this moment of heightened attention into lasting success will determine if it can move beyond its current microcap status into a more substantial player in the industry.