As the summer of 2023 unfolded, a wave of hope washed over millions of federal student loan borrowers. An email from the Biden administration suggested that student debt relief was imminent, igniting optimism among those burdened by educational loans. However, the tide turned unexpectedly when legal challenges arose to thwart these efforts, leaving borrowers in limbo.

On September 5, U.S. District Judge Randal Hall in Georgia issued a temporary restraining order that put the brakes on President Biden’s efforts to implement a new student debt cancellation plan. This order was a response to a lawsuit from seven Republican-led states—Alabama, Arkansas, Florida, Georgia, Missouri, North Dakota, and Ohio—who argued that the U.S. Department of Education exceeded its legal authority in attempting to forgive student loans. This situation presents a stark reminder of the political and legal complexities that surround educational debt in America.

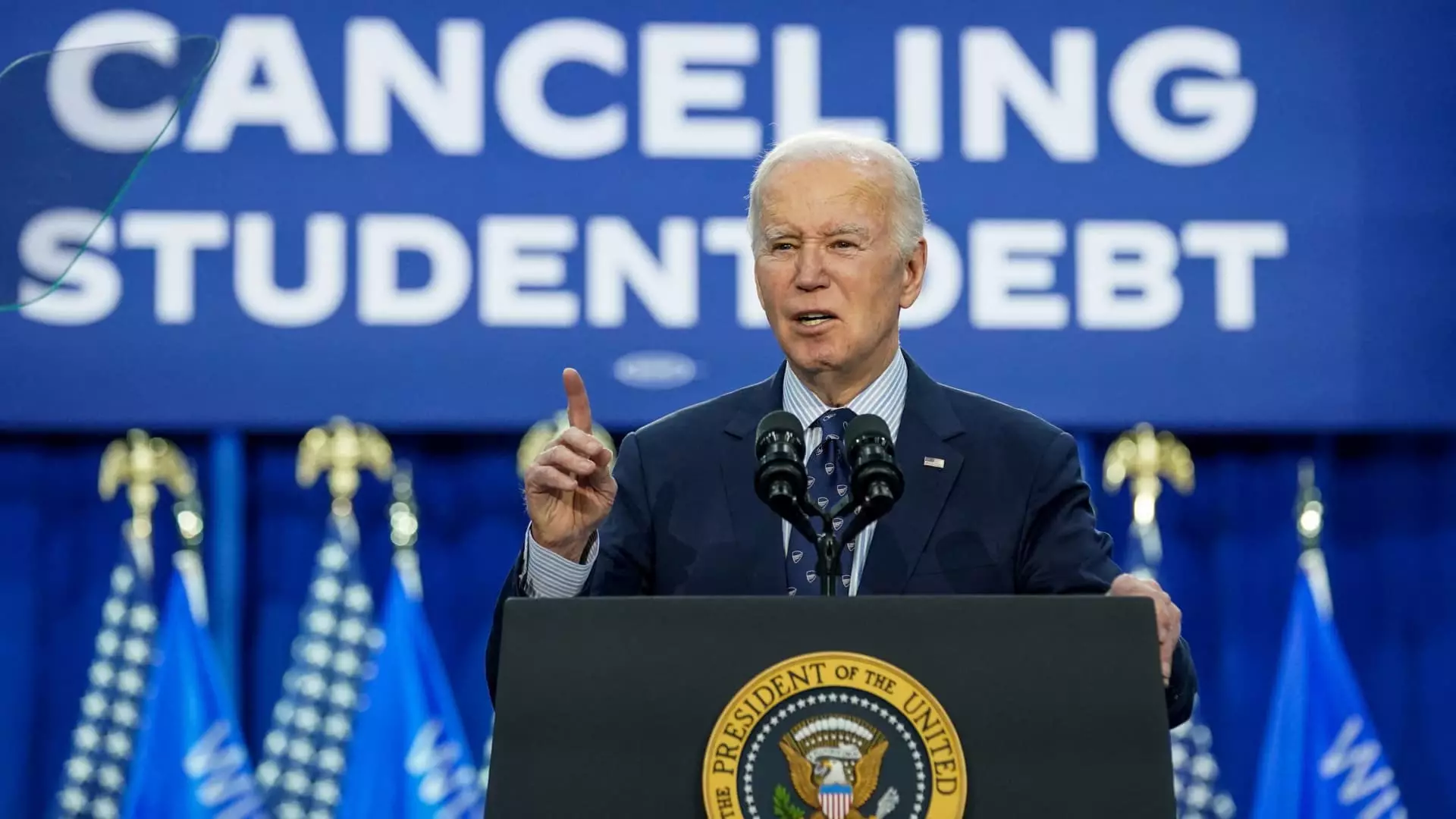

The Biden administration’s first foray into student debt forgiveness was controversial. In 2022, an attempt to wipe out approximately $400 billion in student debt was declared unconstitutional by the Supreme Court. Though this setback could have demoralized the administration, President Biden remained resolute in his commitment to find alternative paths for debt relief. The administration’s pivot to a regulatory approach was deemed a more strategic maneuver, presumably designed to withstand legal scrutiny better than executive orders. However, the very nature of its regulatory path now faces a litigious blockade.

Judge Hall’s temporary restraining order underscores the Republican states’ assertion that the Education Department is overstepping its boundaries. Legal experts like Luke Herrine suggest that while the order is currently restrained, it does not entirely halt preparations for the debt forgiveness process. The real question lies in whether or not the administration will be able to initiate loan cancellations until the courts reach a decision, which some anticipate could drag out for several months. This uncertainty could have dire implications for student borrowers, who are eagerly awaiting relief yet face an intricate legal landscape.

The complexity of the judicial process surrounding the proposed debt cancellation plan raises serious concerns about how bureaucratic measures might interact with political maneuvering. The legal challenges not only serve to obstruct the debt relief efforts but also underscore the increasing polarization surrounding educational finance.

As the nation gears up for the 2024 presidential election, it is crucial to note how the student loan debt narrative is woven into the broader political climate. Observers note that the GOP’s legal offensive may be strategically timed to undermine popular Democratic initiatives. Herrine points out that the Republican strategy appears to be motivated by an awareness of public opinion; student debt cancellation resonates with a significant portion of the electorate. In this light, blocking debt forgiveness may serve not only judicial interests but also electoral ones.

Furthermore, the Biden administration’s ongoing efforts to promote a new repayment plan called SAVE are hindered by similar legal challenges. As things currently stand, borrowers enrolled in this initiative can postpone payments, a temporary relief that could be short-lived depending on the evolving legal situation. The tendency towards litigation serves to amplify the uncertainty of student debt management under the current administration, leaving many borrowers in a state of anxiety.

Amid this chaotic mix of court decisions and regulatory attempts, the future of student loan forgiveness remains precariously balanced. Many borrowers may feel like pawns in a much larger game of political chess, caught between the ambitions of an administration and the resistance of its opponents. This uncertain terrain poses profound questions about the efficacy of student loan policies and whether they can truly meet the needs of those drowning in debt.

As the Biden administration works to finalize its plan while navigating the legal labyrinth, borrowers must remain informed and prepared for various outcomes. With the potential for changes on multiple fronts—legal rulings, repayment plans, and broader political developments—the experience of borrowers varies widely. Some may find hope in the promise of eventual relief, while others are left grappling with disillusionment.

The legal wrangling surrounding student loan forgiveness is emblematic of the broader challenges within American public policy. It highlights the difficulties of introducing and implementing measures that could alleviate economic burdens on individuals, particularly in a politicized environment. As consumers of educational services, borrowers deserve transparency and clarity in their pursuit of debt relief, an ideal that remains frustratingly elusive for now.