The recent turmoil surrounding the Consumer Financial Protection Bureau (CFPB) has raised questions about the agency’s future, effectiveness, and commitment to consumer protection. This article dissects the events that have triggered significant concern among CFPB employees and the broader financial regulatory landscape, patterning it against a backdrop of political strategies, agency roles, and the future of consumer rights.

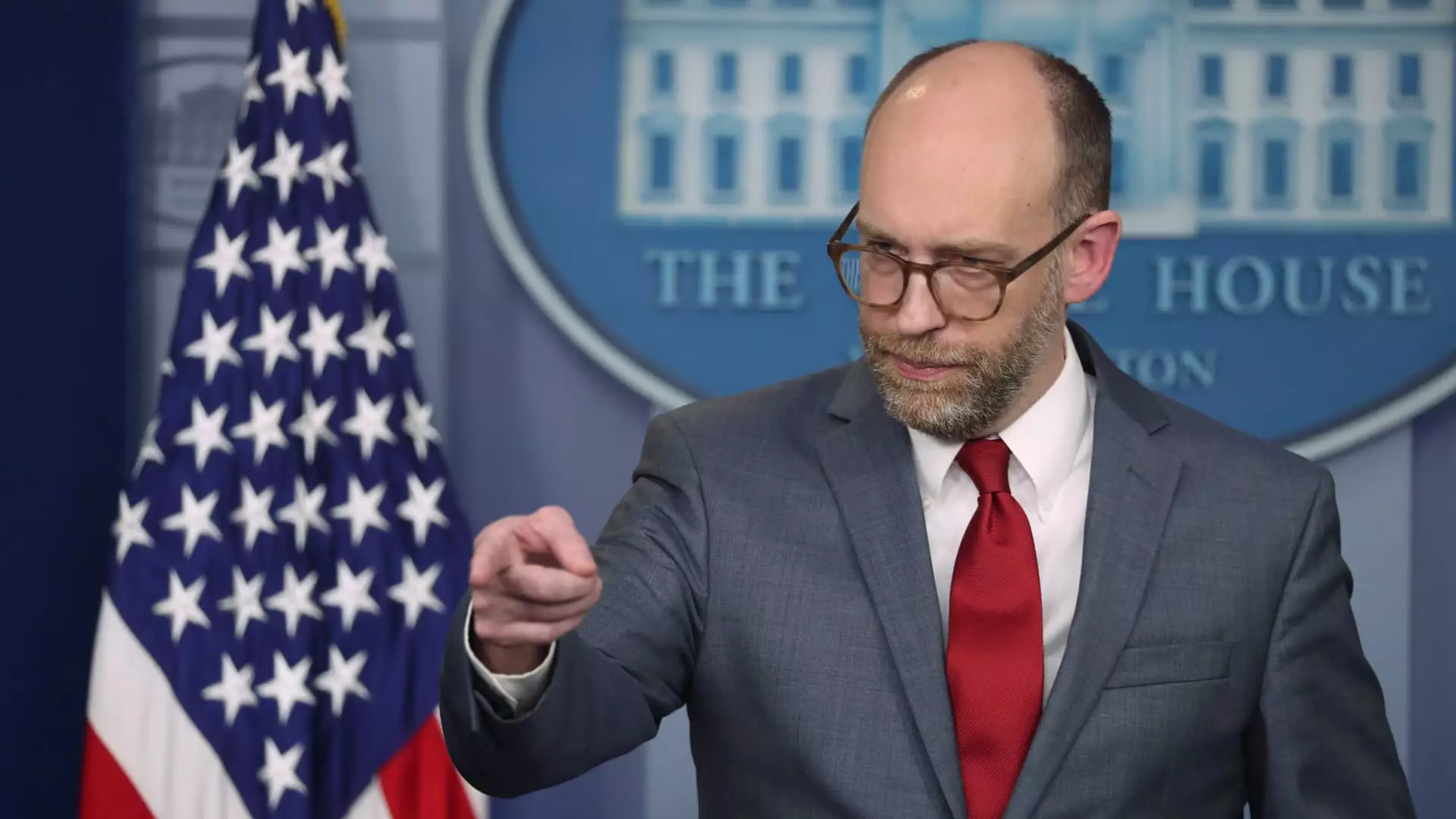

On February 14, 2024, CFPB employees were instructed to work remotely following a memo from Chief Operating Officer Adam Martinez. This decision was a part of a sweeping operational suspension initiated by new acting director Russell Vought, who directed staff to halt nearly all regulatory activities. Such drastic measures seem to signal an atmosphere of uncertainty and instability within an organization designed to protect consumers from financial malpractice.

This abrupt operational shift appears to stem from recent political maneuvers linked to external corporate influences. Notably, reports have surfaced about personnel from companies associated with Elon Musk gaining unrestricted access to sensitive CFPB data, including confidential staff performance metrics. This situation raises red flags regarding oversight and accountability, particularly since Musk has openly advocated for dismantling the CFPB.

The Political Machinations Behind CFPB’s Challenges

Vought’s decision to halt operational activities and financial support for the CFPB is not merely an isolated action but part of a broader ideological agenda. As part of President Donald Trump’s administration, which has consistently targeted regulatory agencies perceived as hinderances to corporate profit, Vought’s actions align with the controversial Project 2025. This strategic plan seeks to reshape federal agencies, which critics argue renders consumer protections vulnerable to manipulative corporate interests.

A chilling tweet from Musk stating “CFPB RIP” encapsulates a wider ideological battle. It reflects a narrative that questions the legitimacy of financial regulatory bodies while offering undue influence from powerful tech entrepreneurs. Such external pressures compromise the agency’s operational integrity and focus on its core mission – safeguarding consumer interests in financial dealings.

With approximately 1,700 employees at the CFPB, the potential for administrative leave or mass layoffs looms ominously over the bureau. Only a fraction of these roles are mandated by law, heightening concerns about the integrity and functionality of the agency over time. Layoffs risk undermining decades of progress toward consumer protection that emerged after the 2008 financial crisis.

The CFPB was established to ensure that financial institutions adhere to fair and just practices. Previous initiatives—including efforts to limit exorbitant credit card and overdraft fees—have collectively aimed to put billions of dollars back into the hands of consumers. If left unchecked, a wave of firings could not only jeopardize ongoing projects but potentially retreat the hard-won rights of millions who depend on such regulations.

The systemic challenges faced by the CFPB are symptomatic of a larger struggle between consumer rights and corporate interests. Banking trade groups have consistently expressed dissatisfaction with the CFPB, attempting to challenge its constitutionality and regulations through legal channels. This strain is indicative of a hostile environment where consumer protection mechanisms are seen as barriers to profit rather than essential safeguards against exploitation.

The risk of repealing consumer protections is not abstract; concrete consequences could manifest in increased fees, loan denials, and eventual exploitation of vulnerable populations. If successful, initiatives designed to shield consumers—such as removing significant medical debts from credit reports—face the possibility of being stripped away, placing millions at risk.

The current upheaval at the Consumer Financial Protection Bureau requires urgent attention, not just from policymakers but from consumers and advocates as well. The actions taken by leaders like Russell Vought, mired in political ideology and corporate influence, are poised to jeopardize consumer protections achieved over years of advocacy and reform. As stakeholders in the financial ecosystem, we must advocate for transparency, accountability, and the preservation of the CFPB’s mission to protect the most vulnerable among us from financial exploitation. In doing so, we safeguard not just consumer interests, but the integrity of our financial systems as a whole.