Warren Buffett, the renowned CEO of Berkshire Hathaway, has made headlines once again by significantly reducing his investment in Apple Inc., the tech giant that has long been a cornerstone of his investment portfolio. For four consecutive quarters, Buffett has strategically trimmed his stake in Apple, culminating in a reported holding valued at approximately $69.9 billion as of September 30th, according to the company’s third-quarter earnings report. This reduction equates to the sale of nearly 300 million shares, representing about 25% of Berkshire’s total investment in Apple. When measured against the previous year’s holding, this signifies a staggering 67.2% decline.

The reasons behind Buffett’s ongoing sell-off have sparked considerable debate among analysts and shareholders alike. One prevailing theory suggests that the sales reflect concerns about high valuations within the tech sector, compelling Buffett to reposition his investment strategy and diversify Berkshire’s equity portfolio. At times, Apple shares constituted an overwhelming 50% of its equity holdings, leading some to question the wisdom of such concentration in a single stock.

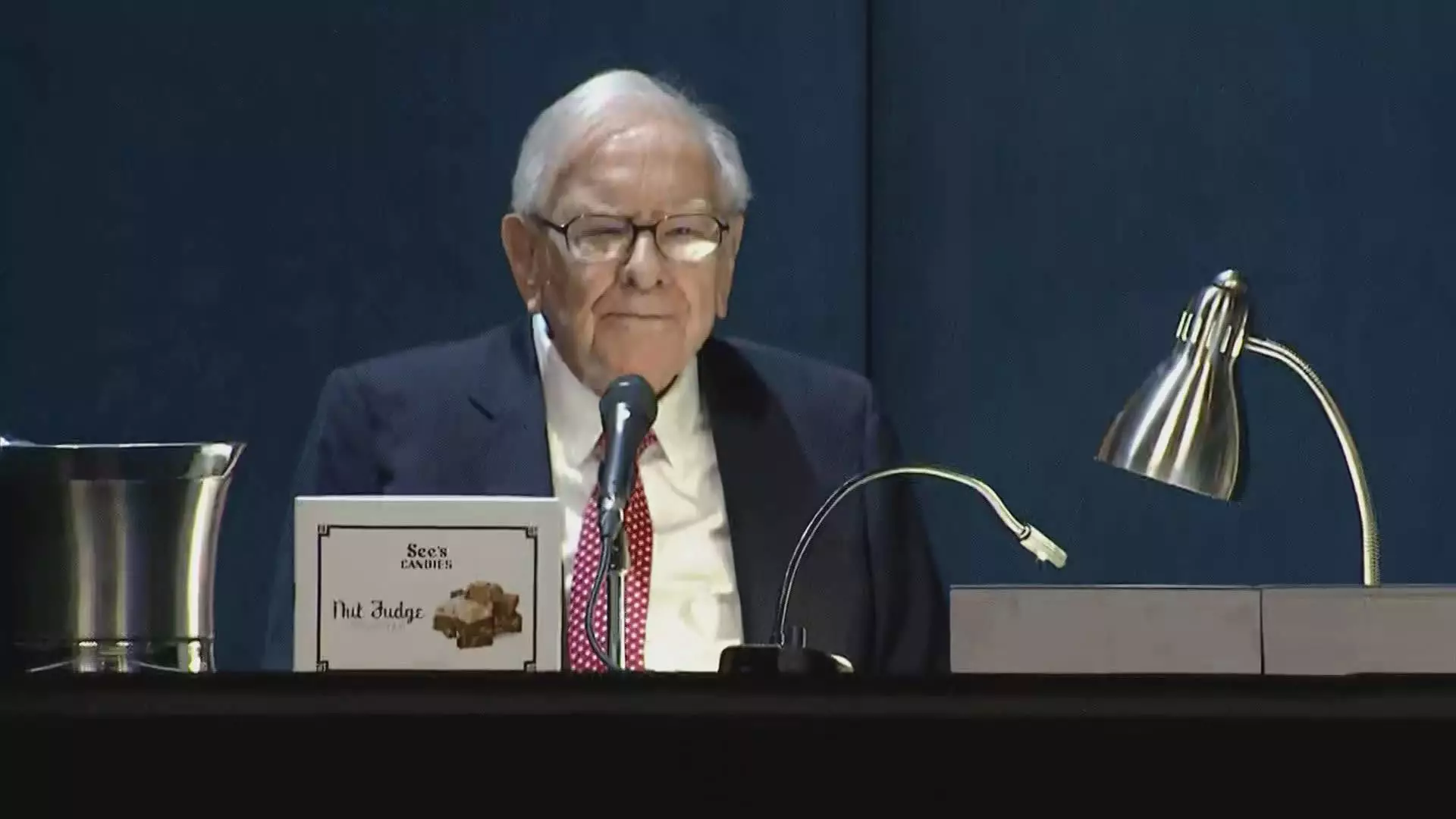

A notable speech Buffett delivered at the annual Berkshire Hathaway meeting in May raised eyebrows when he hinted that potential changes in capital gains tax could be influencing his decisions. He opined that the U.S. government might eventually need to increase taxes to close its fiscal deficit, thereby motivating his sell-off as a proactive measure to mitigate potential tax liabilities. However, given the breadth and consistency of his sales, some speculate that deeper strategic considerations may lie beneath the surface.

Buffett’s journey with Apple is particularly noteworthy considering his historical aversion to technology investments. Prior to entering the tech space, Buffett often shied away from tech companies, citing his lack of “expertise” in the domain. Nevertheless, he was drawn to Apple by its robust customer loyalty and the ubiquitous nature of its products, primarily the iPhone. This infatuation eventually led to Apple becoming Berkshire’s largest equity holding—a transformation that reshaped perceptions of Buffett’s investment style.

As the years progressed, Buffett increasingly positioned Apple as a key player in Berkshire’s portfolio, at one point referring to it as the second-most important business after his well-established insurance companies. This dramatic pivot underlines the evolving nature of Buffett’s investment philosophy and his ability to adapt to changing market landscapes.

In parallel to these adjustments in his Apple holdings, Berkshire’s cash reserves now stand at a record $325.2 billion, further emphasizing Buffett’s strategy to maintain liquidity amid a complex market environment. This monumental cash position has raised questions about future acquisitions, particularly as Berkshire has ceased buyback programs for the quarter.

Apple’s stock performance remains strong, rising 16% year-to-date, although it trails the broader market reflected by a 20% gain in the S&P 500. Moving forward, industry observers will be watching closely to see how Buffett navigates the convergence of a changing economic landscape, the performance of his remaining stake in Apple, and the potential for strategic pivots in investment strategy.

As the iconic figure known as the “Oracle of Omaha” continues to adapt to the demands of contemporary markets, his recent actions at Berkshire Hathaway serve as a reminder of the complexities involved in legacy investing. Ultimately, the long-term implications of his choices regarding Apple will be keenly observed by both critics and supporters.